LTCG – Have you made the most of the grandfathering clause?

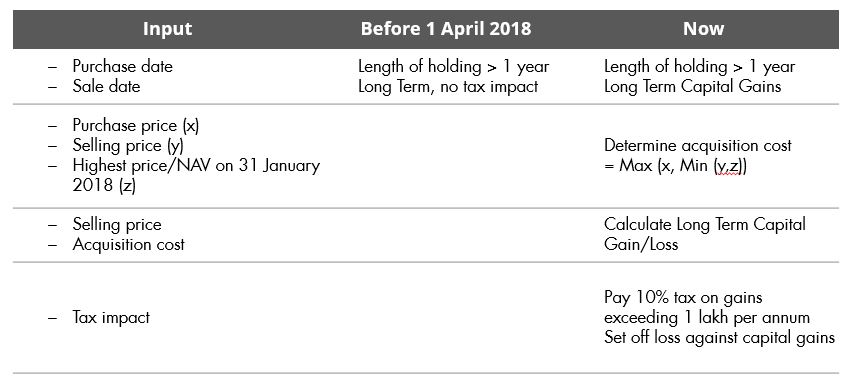

The blow of 10% Long Term Capital Gains (LTCG) tax was softened by the grandfathering clause, which exempts LTCG accrued till 31 January 2018 from this tax.

Equity markets have seen a considerable surge this financial year. However, the grandfathering clause only protects against LTCG made before 1 February 2018. Asset Vantage reports can help you understand how to optimize LTCG tax impact, especially while filing quarterly advance tax.

Nonetheless, the significance of 31 January 2018 will forever increase the complexity of calculating capital gains.

Calculating LTCG manually is both time consuming and subject to human error.

Let Asset Vantage compute your taxable LTCG from realised gains, anytime, with just a click. Track LTCG for unrealised gains and use the information to optimize and plan for advance tax.

The grandfathering clause protects investors against LTCG made before 1 February 2018. Asset Vantage analytics enable smart decisions to optimize tax on LTCG made thereafter.

Have you made the most of Asset Vantage technology yet?