“When I was young, I thought that money was the most important thing in life;

now that I am old, I know that it is.” — Oscar Wilde

- 1. Family Offices – not just for the ultra-rich

- 2. The case for a Family Office

- 3. Evolution of a Family Office

- 4. What you need to set up a Family Office

|

The road to financial freedom |

| Introduction

The world has changed much since Wilde. Many of the institutions he depicted have evolved and been reimagined. While his quip about the importance of money still rings true, there have been substantial changes in the way we think about and manage our wealth. |

|

In its most rudimentary form, a family office is a system through which the day-to-day affairs of a household are managed. Wealth is a fundamental aspect.

The quantification of ‘wealth’ is relative. If you have money, then regardless of its amount, it needs to be managed. It also comes with regulatory responsibilities, must be reported to family members and passed from one generation to another.

It is a misconception that family offices are exorbitant establishments meant only for super-wealthy individuals with complex needs. They come in many shapes and sizes to meet the needs of different types of families. In essence, everybody needs a “family office”. |

A family office setup, whatever its scale, helps you track, consolidate and invest money, and supervise its risk & returns. Therefore, in effect, a family office is nothing but a tool for a family’s financial well-being.

This handbook is designed to bring you knowledge accumulated by the world’s leading experts in family office management. Whether you are a wealthy individual, a family principal or a professional managing a family office, it will provide you with invaluable information about setup and governance, operations and decision-making. |

|

The road to financial freedom |

| Wealth holders’ mindset

Wealthy individuals often fail to treat personal wealth deployment as a business endeavour in itself. They don’t bring the same rigor and discipline that they would apply in other areas of their family business or professional lives. Some distance is required if they are to maintain objectivity, see the full picture of their assets, and make rational, long-term decisions. A family office enables such an outlook by providing a system that clearly demarcates family wealth management from other business interests and household activities.

Complexity Family investment portfolios are no longer straightforward. Globalization has opened up access to diverse investment classes in developed as well as emerging markets. Assets may be spread across several entities, and the ownership structures may be convoluted. This brings with it new complications, such as taxation and burdensome compliance regulations. A family needs a comprehensive accounting capability to deal with them.

Control Control over complicated portfolios is essential to the survival and success of a family’s wealth. Control is achieved by having a clear visibility of all investment-related information in a single place through consolidation. A full picture of up-to-date information makes for better decisions. This further enables a family to accurately forecast cash flows, identify investment risks and exposure, hedge against black swan events and carry out appropriate asset re-allocation. |

Confidentiality

Confidentiality is, rightly, a key concern for all wealth holders. Setting up your private family office reduces reliance on external financial advisors and negates the need to share private data with too many parties. And where external advisors are required, a family office can build in levels of authority and control, so the right information is available to only those who need it.

Succession After a point, wealth accumulation becomes wealth preservation. This requires succession planning and smooth intergenerational wealth transfer. A family office doubles as a framework for succession planning and governance. It provides a strategy that is sensitive to the needs of all parties and maintains records and evidence of investment activities.

Costs Anyone can establish a family office with minimal investment. This system streamlines money management activities, bringing much-needed efficiency and oversight. It saves money, improves returns and cuts risk. These savings add to the capital for investment. When compounded over time, those savings-turned-investments have a profound effect on the long-term value of a portfolio. |

|

The road to financial freedom |

|

Family offices are often seen as the preserve of the ultra-rich. John D Rockefeller Snr., legendary billionaire founder of the Standard Oil Company and a philanthropist, is often credited as the originator of the modern family office. But such structures have existed in some form or another for centuries. Their structure and rules of governance (if such existed) were unique to individual families. In part due to the desire for secrecy and partly because private wealth is subject to less stringent regulation and reporting than, say, a public enterprise.

Many families unknowingly have a semi family office embedded in their business. But by not treating it as an independent entity, its presence remains unnoticed and its potential unfulfilled.

In recent decades, family offices have evolved into a more formal type of institution.Super-wealthy families first established this model for themselves to better manage their wealth and secure the financial success of their family for future generations. Other families, too, began to seek such a system. Over time, a cadre of specialist financial advisors stepped in to establish family offices to service these families. Some family offices that served a single family merged with other offices to achieve economies of scale and serve multiple families. And, as globalization took hold, family offices become multi-jurisdictional. Another interesting contemporary development is that of family offices becoming pseudo hedge funds and de facto venture capital funds.

Families are now hiring competent investment managers. Such a manager can establish an in-house “fund” using the classic hedge fund strategy. This way, family members have a direct say in investment operations. The manager too can focus purely on investment functions instead of spending time on marketing. With a family’s long-term commitment to their own fund, the investment produces higher returns.

As individual venture capitalists, families can invest directly in other businesses. This grants them an investment avenue, beyond typical assets, like stocks, which can generate greater returns. For their part, entrepreneurs prefer family offices for the freedom, flexibility and “patient” capital they offer, compared to private equity or venture capital firms. |

|

The road to financial freedom |

|

Prior to establishing a family office, it is imperative to first understand the basics of wealth management itself.

Family office principals are experts in the fields through which they have earned their wealth. They may be experts in spending it, too! Rarely is managing, sustaining, reporting and managing risk within a diverse portfolio part of their core competency.

Besides learning the ropes of money management, it is essential to have support activities in place. Only then can a family office be an effective and efficient part of the wealth management process. This requires implementing processes for accounting, investment tracking, risk and return analysis and documentation.

Over the past few years, technology has proved to be an excellent enabler for such processes. It automates menial and repetitive functions and offers opportunities to personalize operations as per one’s financial objectives. Cloud computing technology has ushered in innovations such as Software-as-a-Service (SaaS). This makes fully developed software readily available to all via the cloud at a fraction of what it would have cost previously. Thus technology is now affordable and in everyone’s reach. Cloud-based software solutions provide the immediacy and anytime, anywhere access demanded by current generations. But we must recognize that technology both provides new levels of security and raises concerns about privacy. These and other questions are explored in depth in the pages of this resource.

This handbook is a repository of knowledge gathered from personal as well as aggregated experience from working with hundreds of successful global family firms. It contains all you need to know to establish and operate a world-class family office. |

“Watch the little things; a small leak will sink a great ship.” — Benjamin Franklin

- 1. Good wealth management needs excellent accounting

- 2. Reports that show the full picture

- 3. Chart of accounts

- 4. Accounting

- 5. Investment tracking

- 6. Compliance, legal and audit matters

- 7. Remittance processing

- 8. Document storage and retrieval

- 9. Family Office team structure, team profile and costs

- 10. Use technology and educate yourself

- 11. Key takeaways

|

The road to financial freedom |

|

The generic term ‘finance’ encompasses a wide range of activities. It includes various functions, of which investment management and accounting are two major pillars.

One of the family office’s primary function is to determine risks and maximize return from investments. For this purpose, decision makers need accurate and detailed information that is presented efficiently and on a real-time basis.

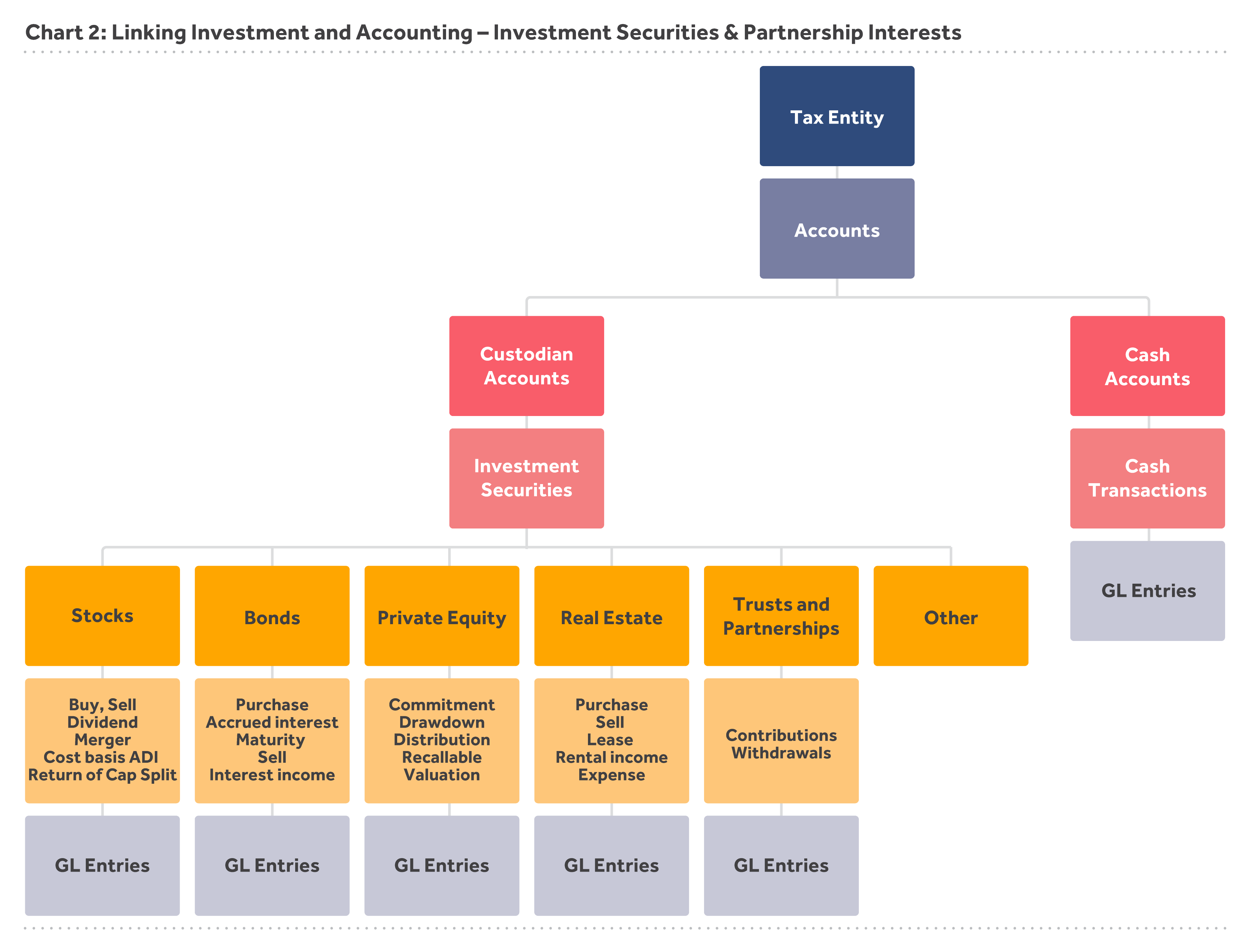

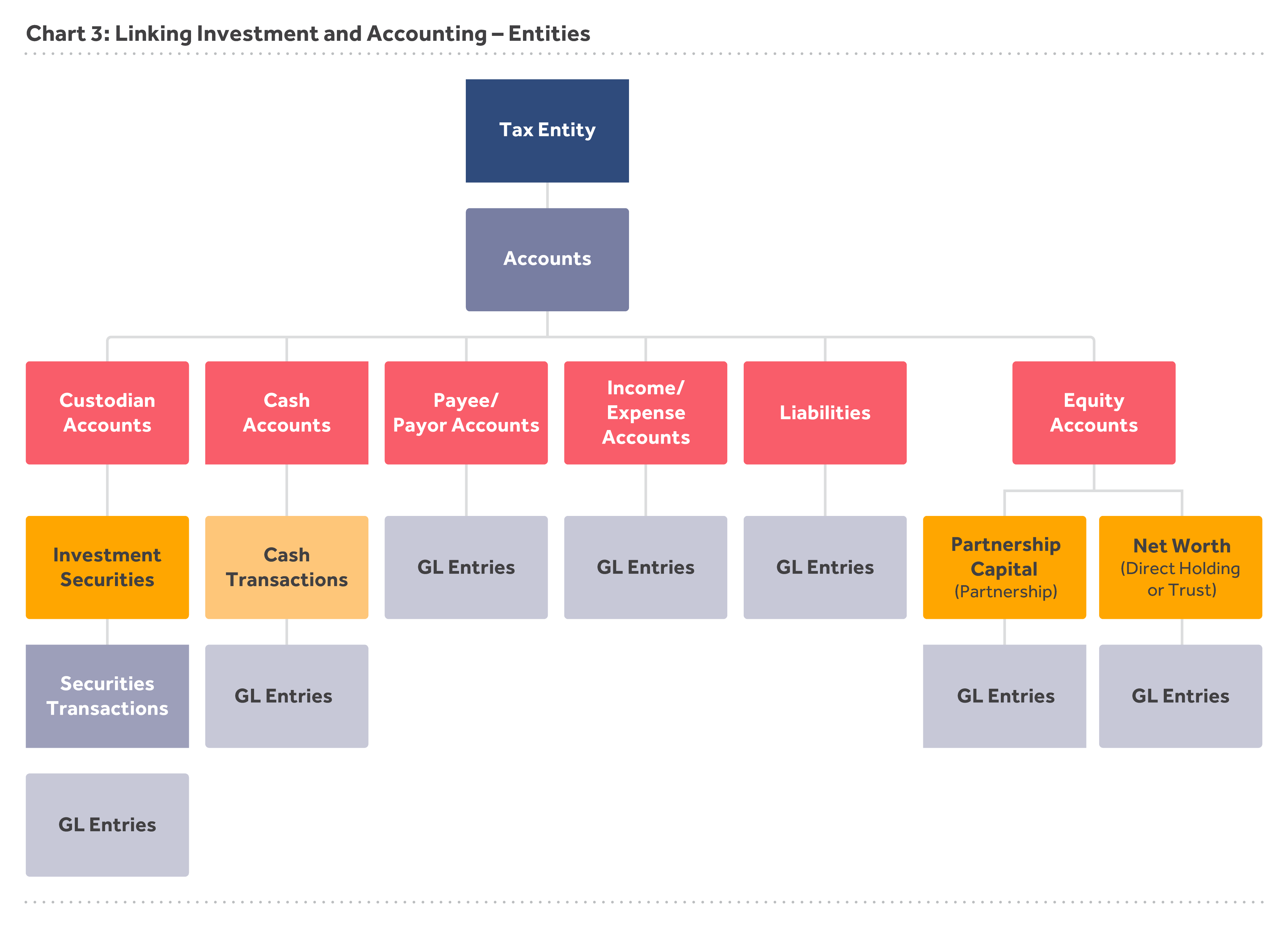

Investments can be held directly by an individual family member or through an intricate structure of trusts and partnerships. Such complex information can be captured only if a robust, modern and dynamic accounting system is in place. After all, investments and accounting are linked: Daily accounting and administrative tasks determine the overall success and effectiveness of a family office. Best practices indicate that accounting operations and controls should be closely aligned to investment management activities. |

An ideal family office investment and accounting system is one which:

The system should be designed to show the full and correct picture of the family’s wealth, including all of its assets, liabilities and expenses in a single frame. |

|

The road to financial freedom |

|

A consolidated and accurate presentation, with the capability to provide underlying details on demand, allows the family principal, or his or her professional advisors, to effectively analyze total performance of the investments. A comprehensive analysis includes deliberation on:

A dynamic accounting and investment management system is one that is capable of generating summary and detailed reports that aid performance analysis such as:

|

In addition to basic financial statements, the system should be equipped to produce detailed investment-related information in a comprehensible and well-structured format. It should be able to calculate metrics such as internal rate of return, standard deviation, and capital account value. (Key investment risk and return valuation measures are addressed later in the handbook).

The system should also be able to output data that can be easily filtered and sorted for preparation of regulatory filings and tax preparation.

The following sections contain suggested best practices to establish standard processes and procedures for accounting, reporting and monitoring of investments. |

|

The road to financial freedom |

|

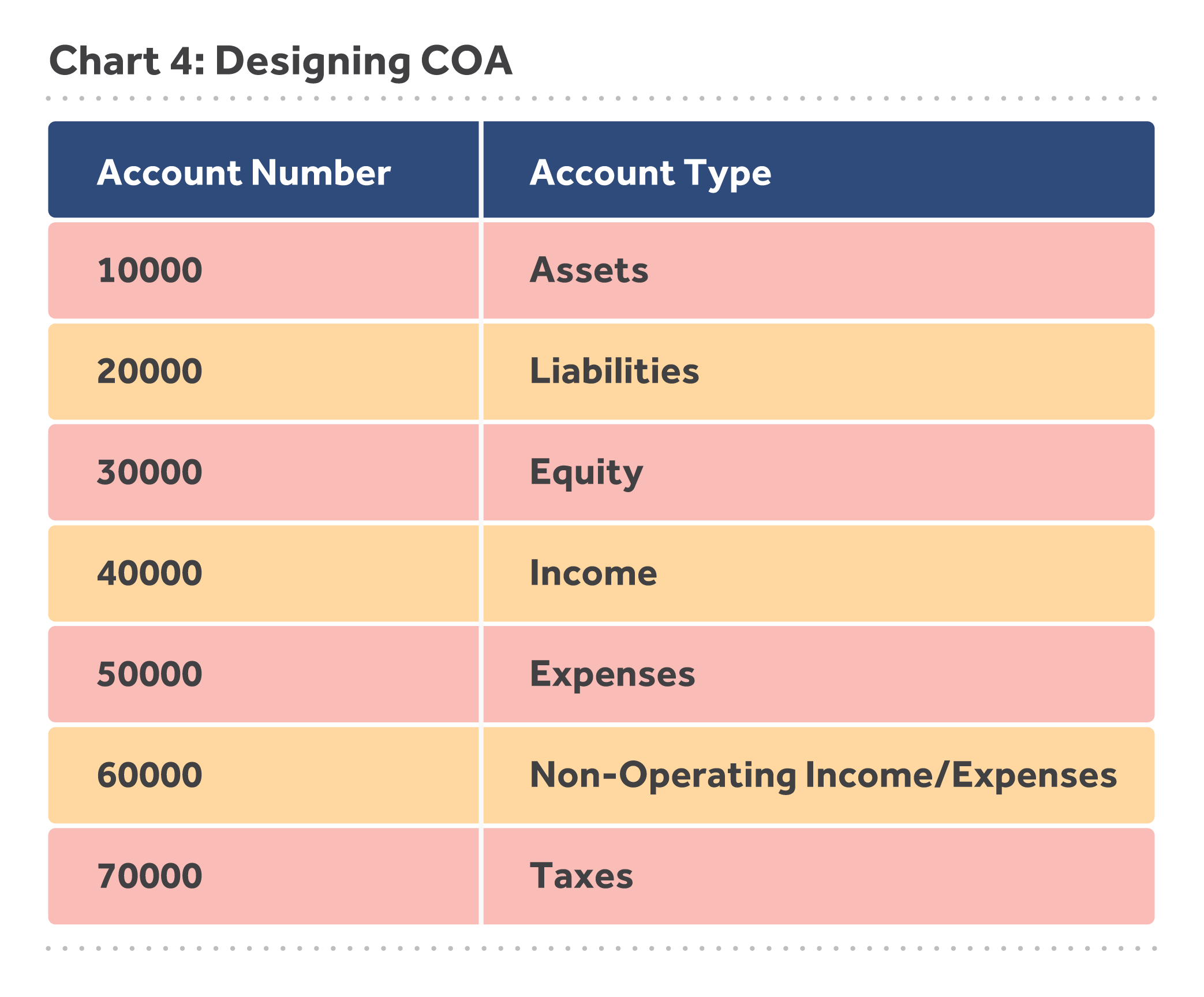

“A well-designed COA supports all of the organization’s information, reporting, and accounting needs, and is built on a foundation of consistent definitions for business attributes and data elements.” — “Unlock value through your Chart of Accounts” article published by Deloitte

A chart of accounts (COA) is an index of all ledgers maintained by an entity. It classifies financial transactions into balance sheet and income statement categories. This organizes the financial information, gives clearer insight into financial health, helps to comply with accounting and reporting standards, and facilitates smooth generation of analytical and regulatory reports. The COA should be built with inputs from an accounting professional, to be compliant with accounting standards and Generally Accepted Accounting Principles (GAAP). |

Where a family invests in assets through multiple entities like trusts and partnerships, it is advisable to use a single accounting and investment platform for all of them. This platform should have the capability to distinguish and maintain individual data of the different entities. Information of investments held and income earned through these partnerships can then be automatically consolidated from the bottom-up. This is an efficient way to carry out overall family office investment reporting and performance analysis.

Such a system further helps to maintain the shareholder relationship between entities and facilitates inter-entity transactions.

All the entities should have the same general COA structure in order to facilitate such consolidation and comprehensive reporting. |

|

|

|

To optimize your family office’s COA, consider the following aspects:

Design

Maintenance

Review The COA is reviewed every 3-5 years to ensure alignment with activities and information requirements. |

|

These aspects are explored in detail below:

Designing the COA All stakeholders, including the CFO, accounting staff, investment advisors and tax consultants, should be involved in designing the COA. This will ensure the needs of various end users of the accounting system are met:

The COA must be standardized. It is advisable to assign account numbers to avoid confusion. Use sub-accounts to enable detailed reporting, without overly complicating the COA structure. |

The COA should be as simple and concise as possible. Do not create unnecessary or duplicate accounts. It is acceptable to create blank accounts for future contingencies, but avoid creating too many unused accounts. This will make it easier for ongoing maintenance and review the COA. |

|

|

|

Maintenance Standardized and documented controls and procedures should be followed for maintenance of the COA:

|

Reviewing the COA Review the efficiency and standardization of the COA every 3-5 years. Check if it:

|

|

|

|

The road to financial freedom |

|

The COA creates a solid structure for the family office’s accounting system. But its full benefit is realized only by incorporating the best practices in recording transactions.

While families normally have a reasonable understanding of their income, the full scope and magnitude of expenses is not always clear. This applies to both investment-related as well as personal expenses. By focusing on just the income, they see only half of the picture.

Tracking investment-related expenses is crucial for calculating net return on investments. The potential for tax deductibility of expenditures must also be considered and accounted for.

The family should also track personal, office and other spending. This is a precursor to better decision making on one’s cash flow and long-term financial planning.

Balance sheet and Income statement Income and expense should be recorded on an accrual or cash basis as per applicable accounting standards. Then it must be reconciled against actual realization and incurrence respectively. Such recording and monitoring must happen on a weekly basis. Where discrepancies exist, it is important to follow up promptly.

Appendix 1 contains the standard operating practices that an accountant should follow to accurately journalize and reconcile key transactions. |

Capital transactions involving fixed assets and notional charges such as depreciation are an important part of running a family office too. Appendix 2 contains the standard operating practices for fixed assets procurement, disposal, physical verification and depreciation.

Regular broker, custodian and bank reconciliations are an essential part of data verification and controls. Standard procedures around them can be found in Appendix 3.

Essential activities around financial period closings and reporting are included in Appendix 4.

Statement of cash flows A statement of cash flows should be prepared periodically (at least monthly) to estimate funds required for the period. It should be prepared for 3 months on a rolling basis to provide better information to support investment decisions.

The statement should consist of funds expected to be received (inflow) and expected pay-outs (outflow). The inflow should include income and maturity of investments. The outflow should include expenses for the period. Details of inflow and outflow should be obtained from those with knowledge, verified by the accounts team and approved by the head of accounts.

The forecasted statement of cash flows should be compared with the actual cash flow statement for the period. Any large variances warrant a root-cause analysis for discrepancies and resolution. |

|

|

| Investment-specific accounting

The management team should develop and approve a framework for investment processing and accounting. This will act as a guide to investment decisions. The framework should consist of details on types of permissible investments, proportion of investments to be made in each type, duration of investments and authorization procedures.

An ideal trade investment execution process covering the various steps of an equity transaction is set out in Appendix 5. It covers pre-trade and post-trade execution best practices that should be put in place to ensure smooth, error-free process flow. |

Detailed steps for processing, accounting and redemption of investments are in Appendix 6.

Computing gains or losses on sale of investments is critical for establishing tax liabilities and computing net returns. Therefore, investments in various assets must be recorded correctly.unts.

The forecasted statement of cash flows should be compared with the actual cash flow statement for the period. Any large variances warrant a root-cause analysis for discrepancies and resolution. |

|

The road to financial freedom |

|

Accountants tend to think in terms of journal entries and ledger balances. But family principals and their advisors are mainly concerned with investment performance. Investment returns are the result of asset allocation and risk – concepts which are explained later in the handbook.

A single, truly robust investment accounting system is one that can generate requisite analytical reports. To meet that need, the books of accounts should be supplemented with investment tracking ability. This capability should extend to directly as well as indirectly held assets. Investment monitoring should further be backed by asset allocation and underlying risk calculation.

Such comprehensive reporting enables principals to exercise control and ask detailed questions.

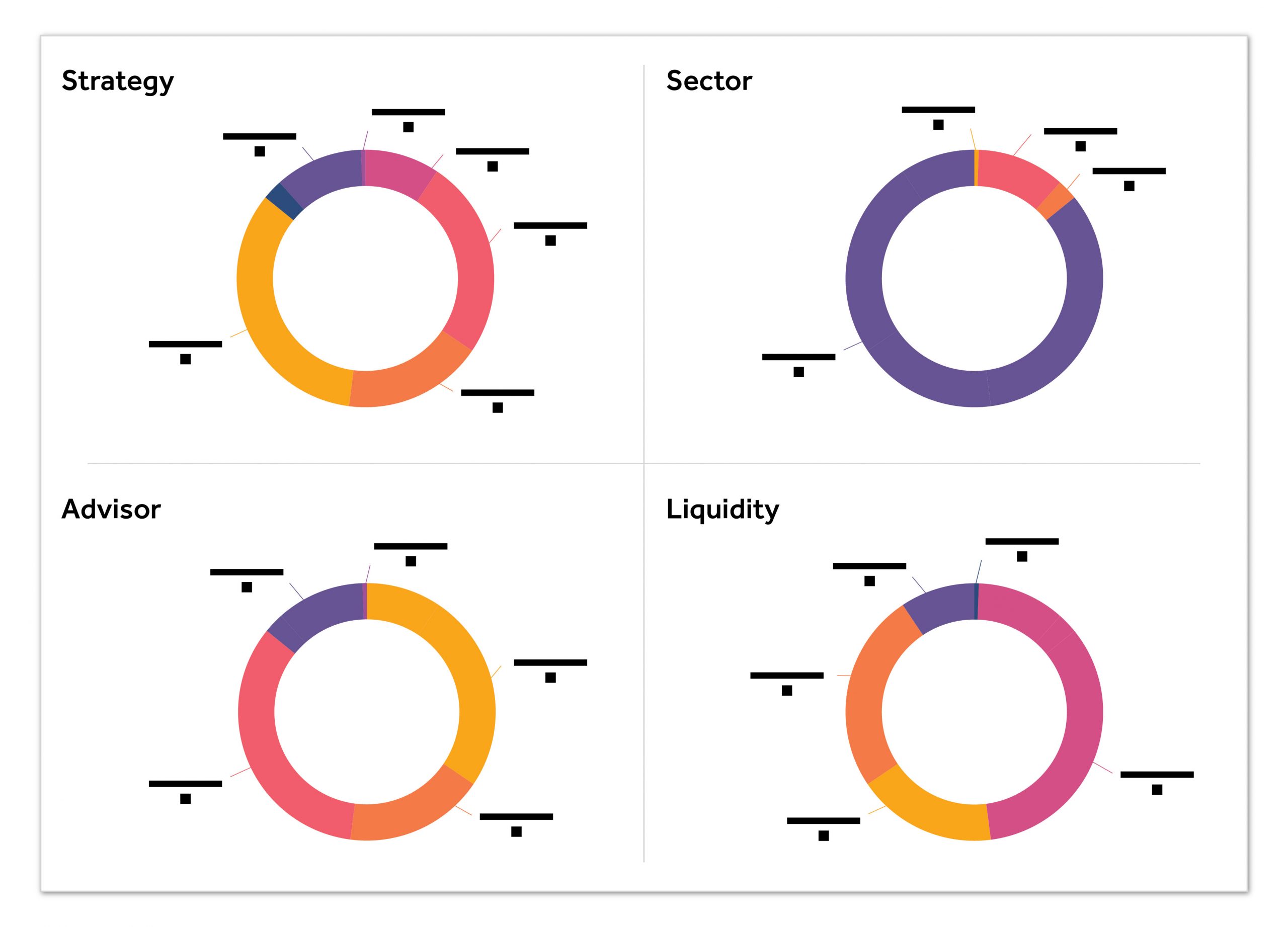

Defining positions The purpose of defining the position of an asset is to facilitate categorization and generation of analytical reports based on those specified categories.

To ‘define’ a position is to tag an investment with its asset-class, sector, liquidity status, country and advisor who recommended or manages the asset. However, such definitions that are assigned by default, may or may not be in line with the investor’s position. For example, an investor may own a few stocks, which are, by default, a liquid investment. But if they are pledged against liabilities, they are illiquid and need to be re-tagged accordingly. Hence the investment accounting system should grant flexibility in tagging and re-tagging investments. |

The naming convention of assets is another important aspect for errorless classification of investments. Although instruments such as derivatives and equities come with industry symbols and identifiers (such as Ticker, ISIN, CUSIP and SEDOL), their classification can be varied by the accountants.

A single listed entity also sometimes issues different kinds of securities, such as equity shares, preference shares and debentures. Therefore, the standardized naming system should clearly distinguish one asset type from another.

Correct groupings allow for positions and strategies in the portfolio to be compared to an appropriate benchmark. These facilitate generation of summary and detailed analytic reports.

Defining advisor and credit ratings Having an advisor master facilitates generation of analytical reports to support review of performance by advisors, ratings and type of equities. For convenience, codes can be allocated to advisors.

A credit rating master maintains a list of fixed income credit ratings from agencies. |

|

The road to financial freedom |

|

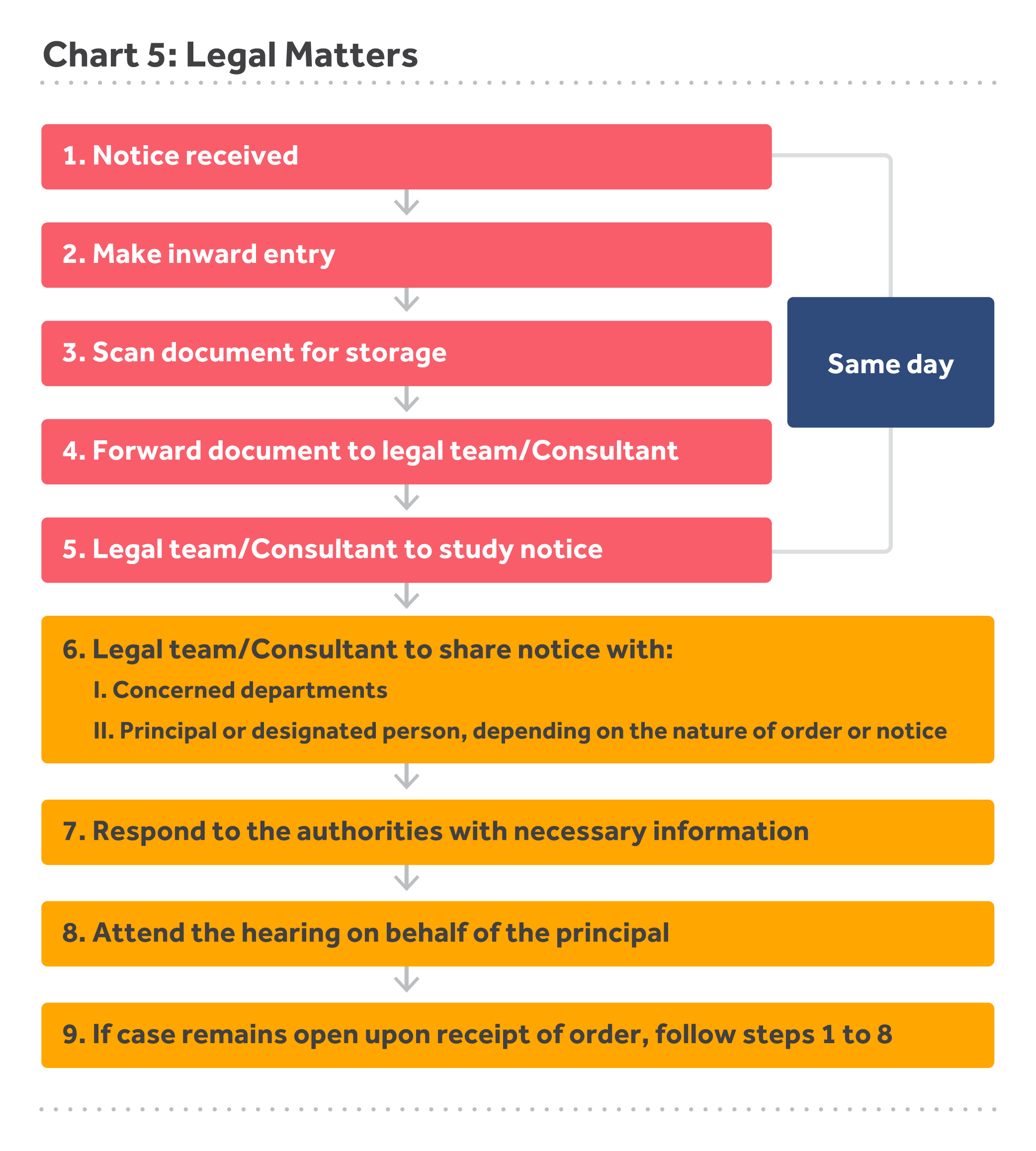

Missed deadlines or errors in legal, regulatory, and tax reporting produce unnecessary risk and potential losses for the firm and the family. These can be avoided when systems are established to provide regular reminders.

Compliance matters Compliance calendars record the frequency of payments and their due dates under different applicable statutes. They serve as the basis of all compliance activities. Sample compliance calendars are in Appendix 7.

Legal matters A tracking system for legal matters should be created in which the responsible team can notify and update details, such as:

An independent checker should verify the tracker periodically to ensure that timely actions are taken. All documents should be scanned and maintained for future references. |

|

The following diagram outlines the process to be followed on receipt of an order or notice: |

Audit matters Audit is an indispensable part of any enterprise. If you are to run your family office as meticulously as a business, the family office, too, needs to have thorough internal and external audit processes in place.

An audit is an important checking and verification tool. It enables control over and visibility of operations. It protects from frauds, identifies loopholes and highlights areas that can be improved. Audits must be performed on:

|

|

The road to financial freedom |

|

A complicated investment portfolio involves many stakeholders and professionals. There is a constant movement of cash. It is not possible for the family principal to authorize every transaction himself or herself, be it an expense or investment. It becomes necessary to delegate authority for approving transactions, while maintaining control and accountability.

The family office should maintain a register of signatories. It defines the following:

|

This register thus serves as a final point of control for cash outflows. It must be designed as an auditable log that lets the principals verify transactions and identify the concerned people.

The register must be updated every time a staff member leaves or there is a change in authority.

Technology, security and processes also have a significant role to play here. |

|

The road to financial freedom |

|

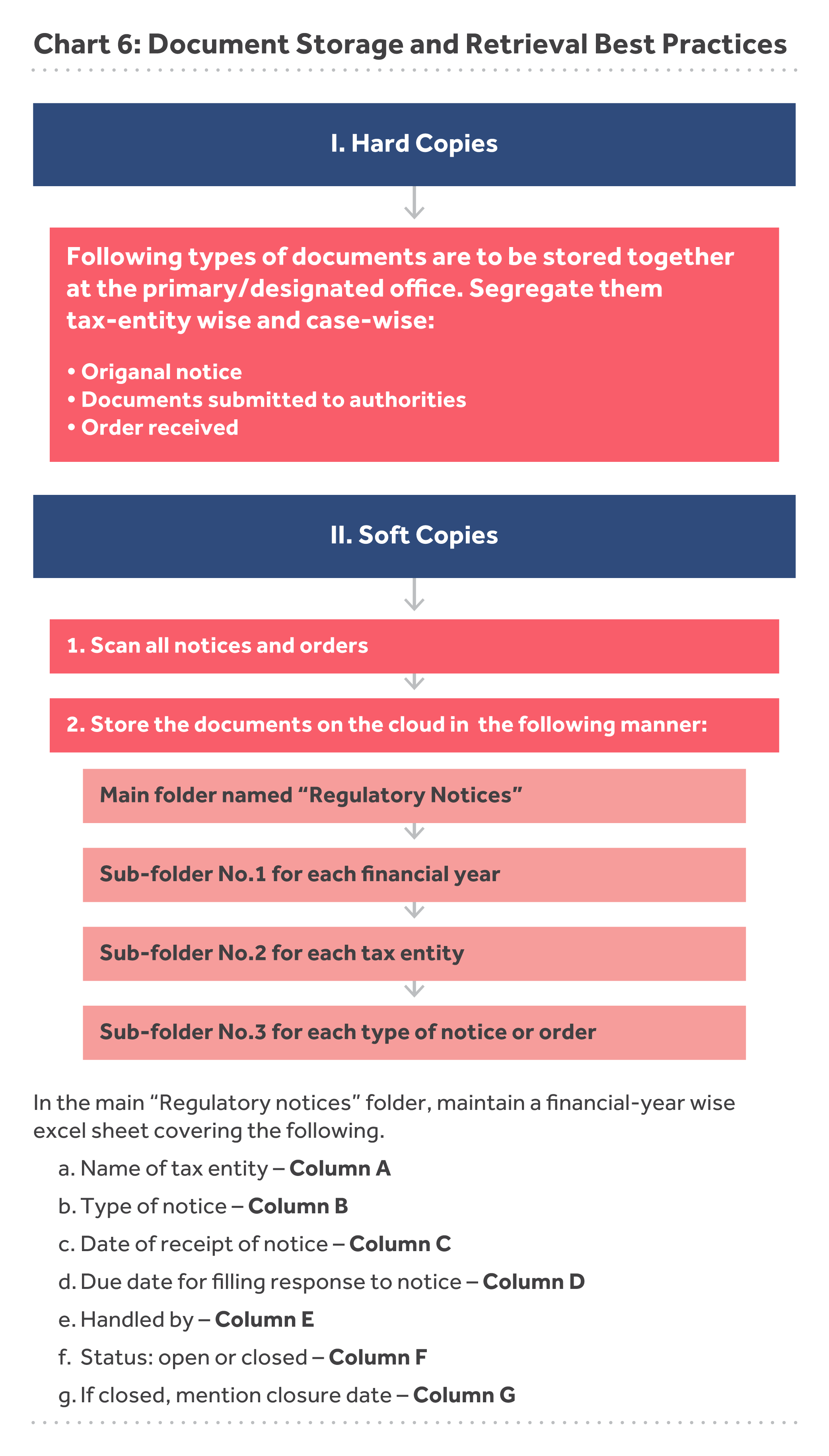

Documents form the basis for identifying and recording transactions. These include agreements, statements, legal notices and invoices. A coherent and consistent system to file and retrieve these documents needs to be maintained.

Best practices which ensure a sound document storage, management and retrieval process are:

|

|

The road to financial freedom |

|

Family offices come in a variety of sizes. They differ in the value of the assets under management, complexity of asset classes, size and number of family investment entities, and the unique lifestyle of the family. Hiring of external advisors and outsourcing certain services also affects the family office team size and structure.

Most small to mid-sized family offices have lean teams of 3-4 members, while large complex family offices can have up to 10-12 people. Regardless of the team size, all family offices should have members possessing certain desired traits and carry out the following roles:

Accounting

|

Compliance and tax

This knowledge is usually brought by a CS/legal professional with 10+ years of compliance/legal experience.

Investment research and advisory

Generally, an MBA in Finance with added qualifications like a CFA and CFP brings this expertise. |

|

|

Advisor and facilitator

|

Administration

Retired professionals with a military background usually fit this role. |

|

|

| Family Office leadership

Family offices can be led by family members or hired professionals. Regardless of whether the leader is internal or external, most successful family offices are led by individuals with the competence and experience of running day to day operations. They should be able to make key decisions and navigate the financial and overall well-being of the family through volatile times.

The best family office organizations are designed to support the core capabilities of the leader. For example, if the leader has a strong finance and investments background, s/he is usually supported by a robust back office operation consisting of a well-balanced team and set of external resources who bring complimentary capabilities.

Managing personal wealth should be treated with the same objectivity as that of a business, and the family office should be designed and set up to mirror it.

|

Family Office costs

Costs for setting up and managing family offices vary significantly. Whether it’s a fully-staffed family office or a modern virtual family office with outsourced professionals, costs can range between 50 bps to 150 bps of assets under management. This excludes fees charged by external asset managers.

One key point to note is that there is no free lunch. You either pay directly for salaries, overheads and outsourcing fees, or these costs are embedded within investment management fees. Some families feel more comfortable when they see their returns net of such costs and not have to deal with the actual transactions.

You need to structure your family office and hire professionals to suit your individual family office needs. |

|

The road to financial freedom |

|

Developing a detailed and integrated investment management and accounting system requires the consideration of multiple facets. The perfect system may be easy to visualize. It’s much more difficult to execute.

Technology has a growing role in enabling processes and controls that allow the streamlining of family office operations. Technology also helps the family office adhere to industry best practices. |

Principals, as noted in the introduction, usually have core competencies in non-financial fields. It is those competencies that have enabled them to create and sustain family wealth. But they are not always comfortable with accounting and investment principles. Acquiring basic knowledge of these financial areas makes for increased control over operational processes and better investment decisions. |

|

The road to financial freedom |

|

“We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas." — Michael Dell

- 1. Expense budgeting & Tax planning

- 2. Cash flow forecasting

- 3. Investing savings

- 4. Key takeaways

|

The road to financial freedom |

|

Every goal needs to be backed by a sturdy yet flexible plan. Families may have a firm grip over their investments’ notional returns, but lose sight of the real item at the end of the day – cash.

When building a plan to achieve your wealth aspirations, supplement it with cash flow forecasts that are as accurate as possible. The most significant yet often omitted factors are:

Both these aspects have consequential effects on asset allocation (explained under Investment Approach), too. |

|

|

|

Many high-income professionals end up with little savings. This is due to not having an expense budget, especially towards personal expenditure.

It is crucial to distinguish personal finances from business finances. But it is also necessary to bring the same financial orderliness and discipline to lifestyle and personal expenses that is applied to business finances. The wealthiest families in the world were quick to realize this.

A budget tells money where to go, so you do not have to wonder where it went. Use technology to track and categorize expenses against a pre-set budget. Keep an eye on the long-term horizon and ask questions like: |

|

|

|

|

Taxation is a substantial part of investment-related expenses. It affects both return on investments and cash flows. Badly planned, it can cause liabilities in the form of penalties and long-drawn expensive litigation with the authorities.

Before undertaking any investment, consult a tax accountant. S/he will shed light on:

|

Where families make charitable donations by transferring stock, they need to consider the impact on their cash inflows and the potential for tax benefits.

A thorough discussion on these lines will enable you to plan your taxes. Carry out periodic taxation reviews to ensure you earn the best possible overall returns within the purview of applicable laws.

Update your compliance calendars to keep a track of legal duties surrounding your investments. This averts undue interest and penalty expenditure.

Expense budgeting and tax planning highlights the importance of building a dynamic Chart of Accounts, which enables accurate tracking of expenses (personal or otherwise), compliance with taxation laws and forecasting of cash flows. |

|

The road to financial freedom |

|

A family may have assets worth USD 10M. But reporting USD 10M and actually having that amount in hand for use are two different things. Half of those assets may be earmarked for investment (say, a property installment or a private equity commitment), or for charity. This, in effect, renders those assets illiquid.

If the family is unknowingly reliant on funds designated for such commitments, it may end up liquidating other assets. It may have to do so at sub-optimal rates, and bear unfavorable tax consequences.

Such unpreparedness and lack of planning usually leads to monetary loss. |

The accounting and reporting system should be able to earmark assets and determine their liquidity status. It should help in generating cash flow forecasts, an example of which is given below:

|

|

The road to financial freedom |

|

“In the long run, it’s not just how much money you make that will determine your future prosperity. It’s how much of that money you put to work by saving it and investing it.” – Peter Lynch, legendary investor and fund manager

Budgeting and forecasting gives control over wealth and plugs expense leakages. This, in turn, leads to additional savings.

The corollary to saving is investing. Money generates returns and mobilizes the power of compounding only upon investment.

The sole creature in the world that never sleeps is interest. Compounding lets you earn not only on the money saved, but also on the interest earned by that money. Thus, money can work round the clock, multiplying or depleting itself.

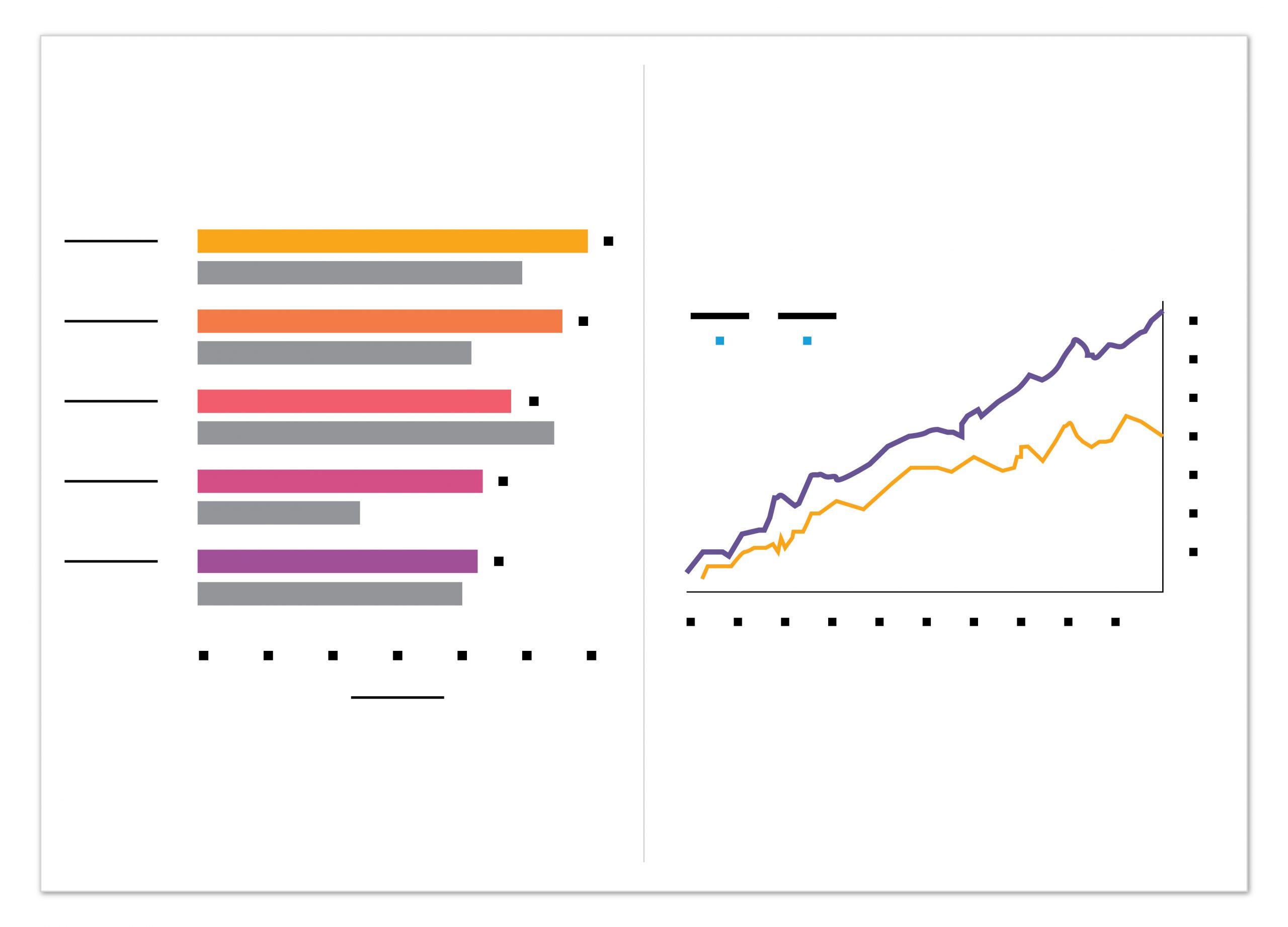

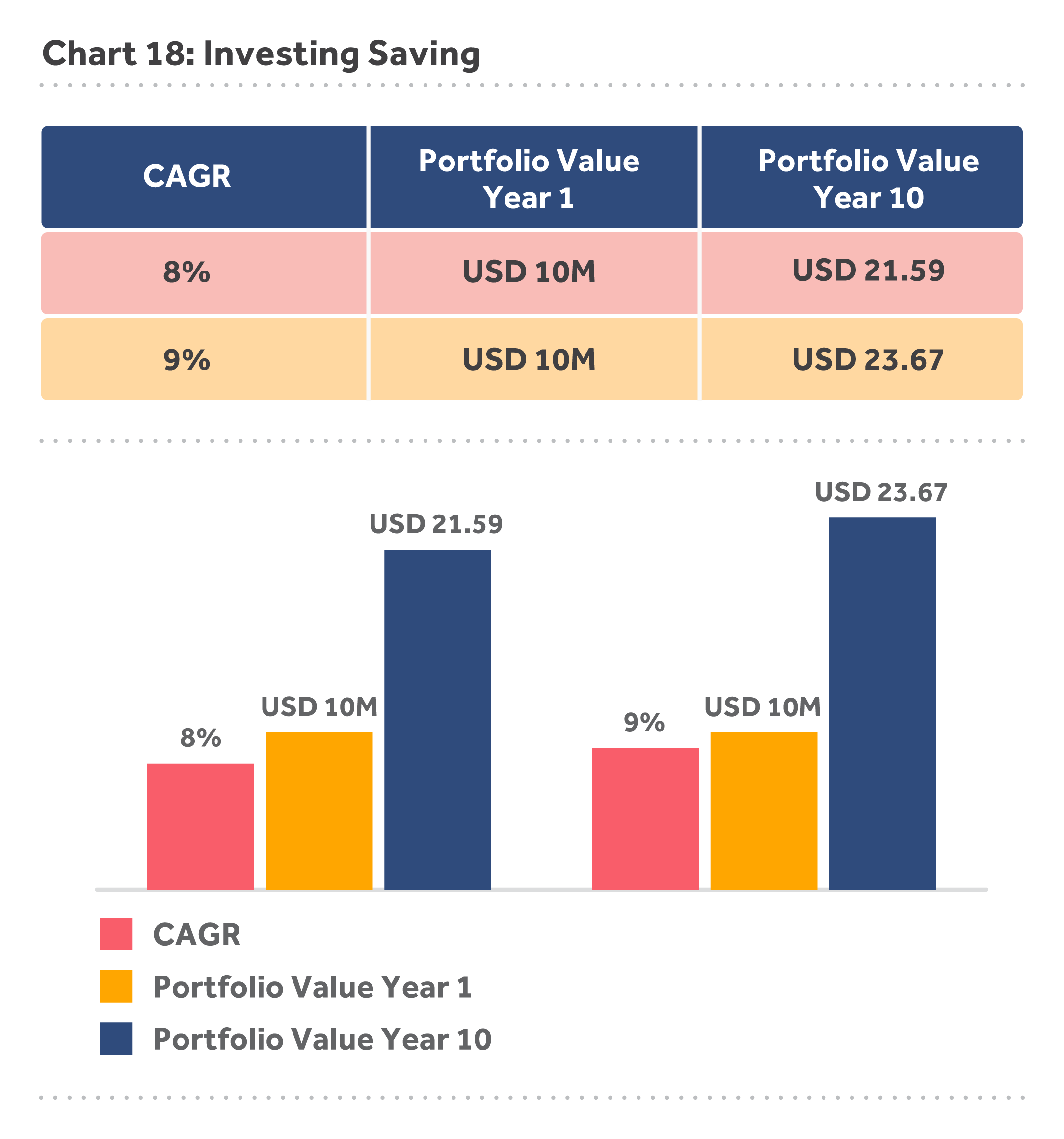

A small increase in returns or reduction in costs will have a dramatic increase in the long-term value of your portfolio. For example, a USD 10M portfolio’s returns increasing by just 1% over 10 years produces an additional return of USD 2M:

Grow your wealth faster than inflation undermines it. Invest in interest or dividend-generating assets. Or earn capital gains by purchasing and selling assets that appreciate in value.

Generate as much passive income as possible. A passive income is one which requires little ongoing participation from you. It exemplifies self-sustaining wealth and financial freedom. |

|

The road to financial freedom |

|

“The only thing that money gives you is the freedom of not having to worry about money.” — Johnny Carson

- 1. Investment management and concepts

- 2. Insurance

- 3. Personal asset management

- 4. Key takeaways

|

The road to financial freedom |

| Investment policy statement

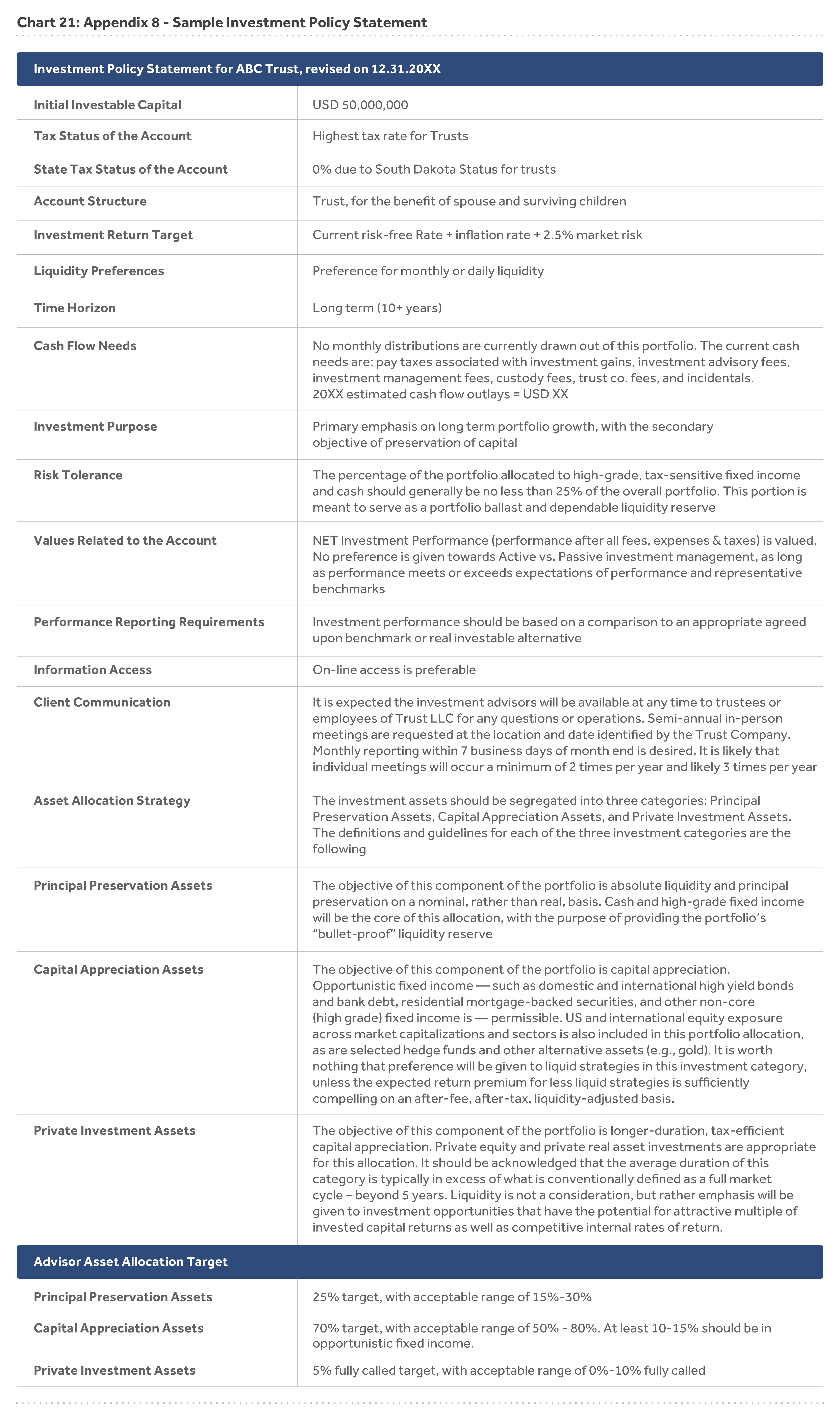

An Investment Policy Statement (IPS) defines the investment goals and objectives of a family. It is a financial roadmap drawn in collaboration with a financial advisor.

An IPS forms the basis for a family’s portfolio construction by describing the strategies to be employed, and processes to measure their outcome.

Following is the outline of an IPS and the areas it should cover. Financial terms, such as asset allocation, risk and benchmarking, are explained in the next section of the handbook. The section also provides you thumb rules for drafting your family office’s IPS.

IPS and governance

|

Investment Function:

Monitoring and Reporting Function:

|

|

|

Investment, return and risk

|

Identification and statement of constraints. These may be related to:

Appendix 8 contains the specimen of a commonly used Investment Policy Statement. |

|

|

| Investment concepts

This section apprises family principals and family office professionals of basic investment terms and portfolio management techniques. This knowledge will help you manage your wealth better and engage in informed conversations with financial advisors.

The aim of investment is to sustain and grow wealth. This allows families to maintain their lifestyles with financial security, even post-retirement. Your investment returns will assure you of this freedom only if they beat inflation.

Returns that surpass inflation rates can be earned by:

|

|

|

| Inflation

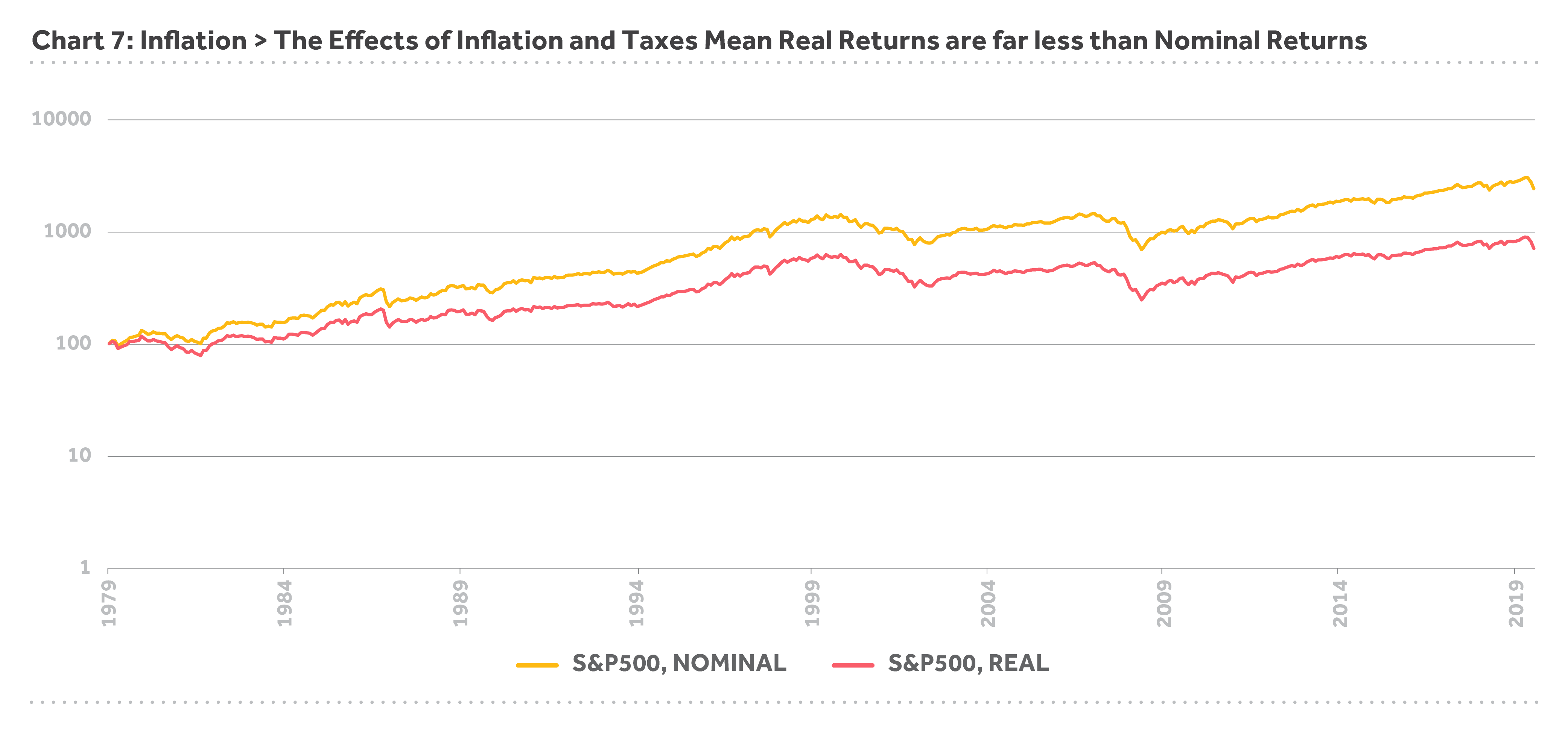

Inflation affects financial planning monumentally. Despite saving and investing money diligently, the actual value of wealth is diluted by rising prices. Inflation cuts into returns, and, in some cases, even induces negative growth.

The effects of inflation and taxes mean real returns are far less than nominal returns: Wealth management fails unless the post-tax returns come out higher than the inflation. Fixed income asset classes provide liquidity for investment and generate stable income and cash flows. But, depending on a country’s nominal inflation rate, they rarely outrun inflation. Only certain asset classes, such as equity, have consistently proven this capability.

|

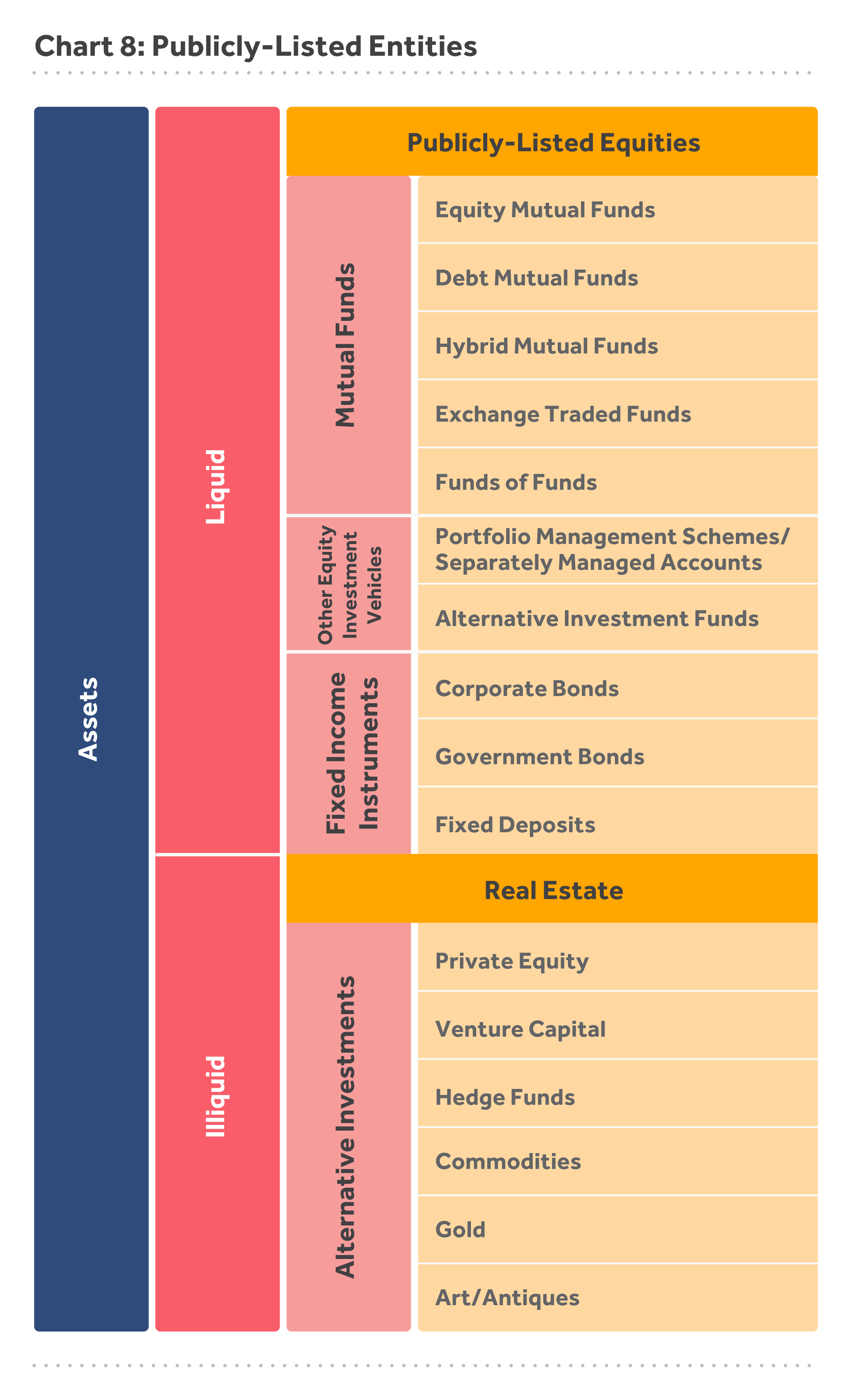

The following is an illustrative list of various asset classes. Knowledge of different investment avenues and their returns allows families and their family office professionals to oversee their investment portfolio. Liquid assets are those which can be readily converted to cash. Whereas illiquid assets do not have regular buyers and sellers. |

|

|

| Wealth trinity – risk, return and time

This section will enable families and their family office professionals to gauge their risk tolerance, and measure returns from diverse investments. This will, in turn, help you draft an effective Investment Policy Statement. |

|

|

| Risk

Risk is the uncertainty in an expected outcome; it is also the possibility of losing some or all of your original investment. Rewards of an investment are tied to the risk associated with it. Higher risk justifies, but does not guarantee, higher returns.

Taking no risk at all does not give the returns required to sustain and grow wealth. Assuming too much risk threatens basic financial security.

The key is to take on calculated risks that promise returns with some degree of certainty. Informed risk-taking is distinct from an outright gamble.

Different kinds of risks, ways of measuring them, and methods for managing risk are:

|

| I Standard deviation (δ)

Standard deviation is an estimation of the expected volatility in an investment’s returns. Volatility is the fluctuation in the returns from an asset over a given period of time.

Two stocks may give the same one-year return of 20%. But, if over those 12 months, returns from one stock rose and fell significantly, with those from the other staying more or less consistent, then the former is riskier than the latter.

Standard deviation measures how the returns from an investment vary with respect to its average returns during a given period. So, if a fund gives an average of 8% yearly returns with a standard deviation of 4%, you can expect returns to vary between 4% and 12%. |

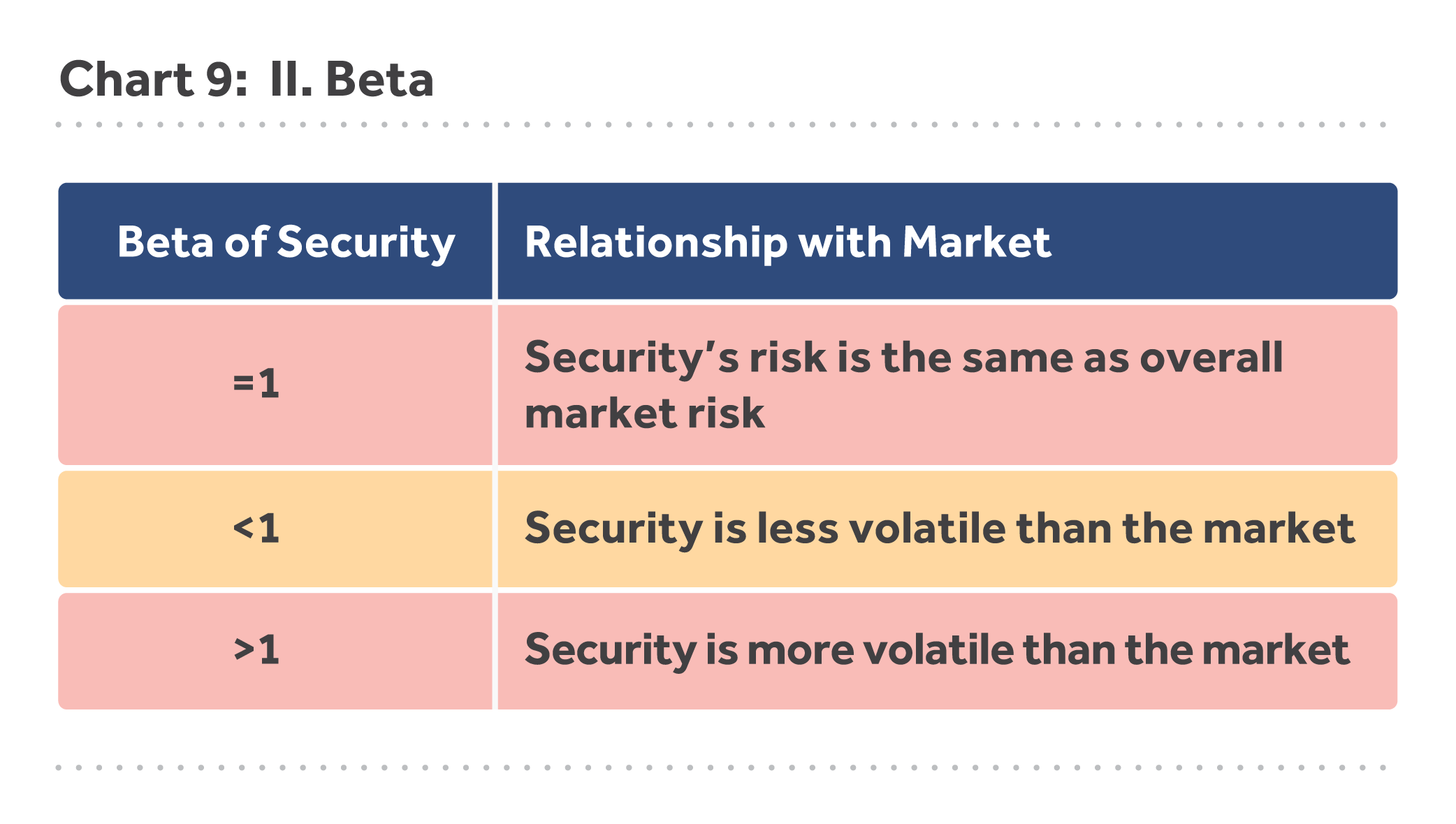

| II Beta (β)

Beta measures the behavior of a stock with respect to the market as a whole. The market is represented by a leading stock market index, the beta of which is always 1. The higher the beta, the higher the risk. If a stock's beta is 1.2, it is theoretically 20% more volatile than the market. |

| III Alpha (α)

Alpha measures the performance of a security on a risk-adjusted basis. It is the excess return of a security over its benchmark. If the market index returns 15% annually over a two-year period, and the investment generates 17% over the same period, the Alpha over the market index is 2% per year.

Risk tolerance differs from person to person and is tied to one’s income, lifestyle, goals and approach in life. This includes the ability to bear notional mark-to-market losses (temporary fluctuations in value) as well as real losses (a company in which you hold shares going defunct).

If you can identify and measure risk with different metrics, you can manage it.

|

|

|

| Return

Akin to assessing risk, correctly measuring returns is also important.

Returns can be measured in various ways. Following are some basic return metrics:

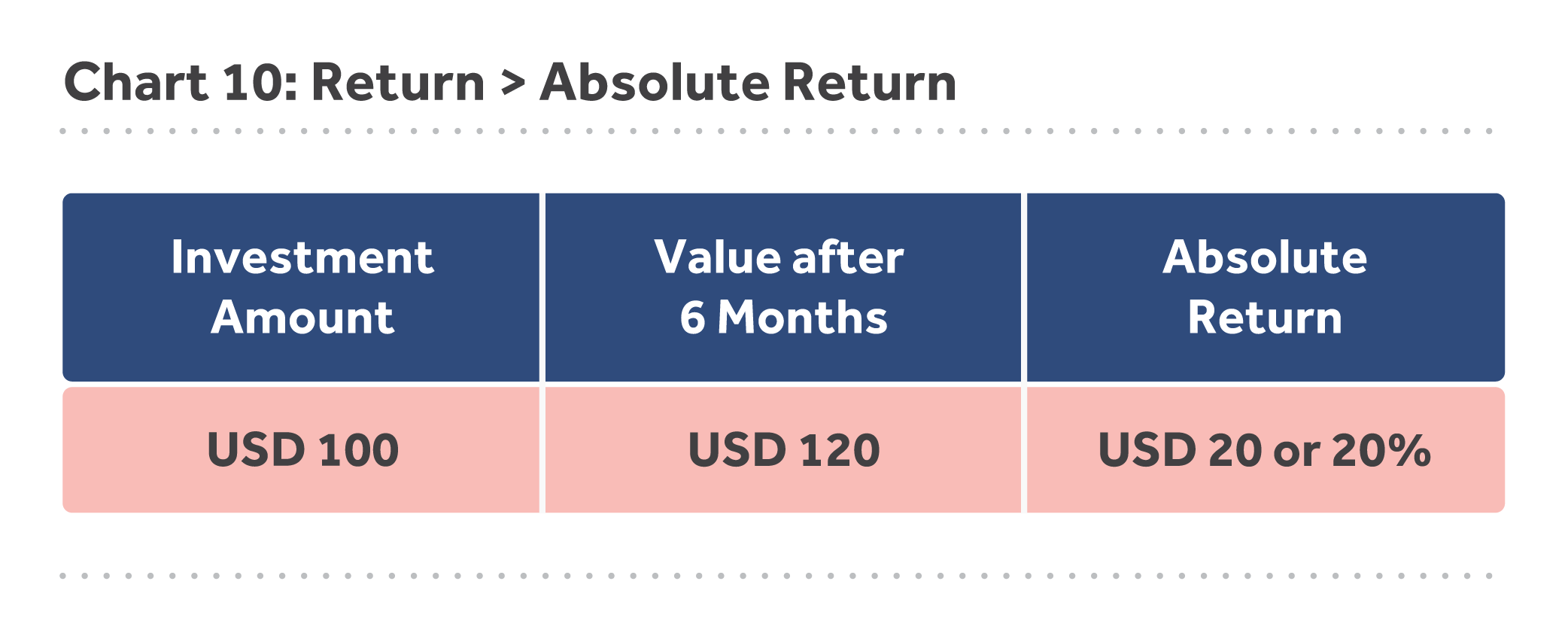

I Absolute return Absolute return is an investment’s returns without accounting for the duration of investment. |

| II Annualized return

Annualized return is the absolute return adjusted for 12 months. |

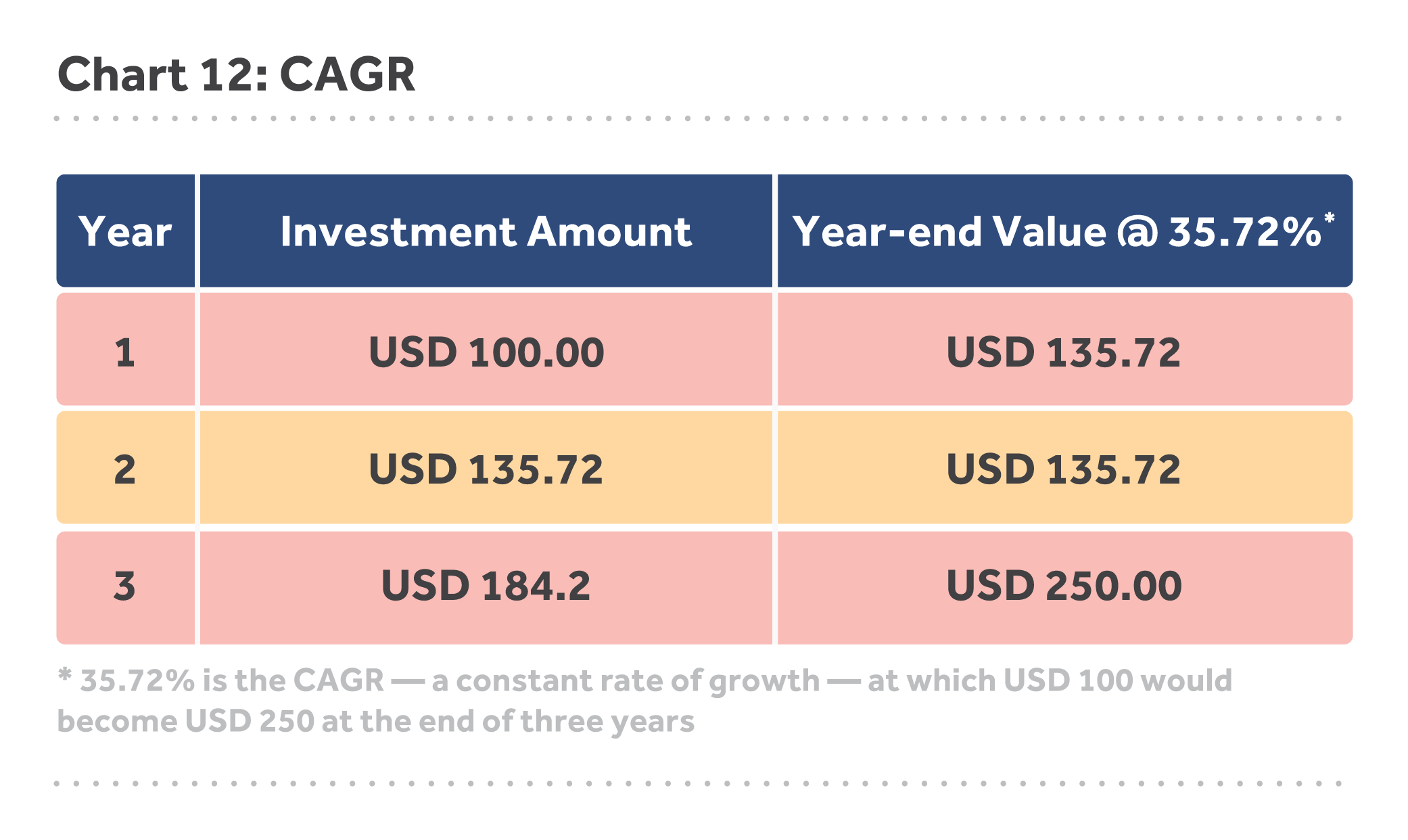

| III Compounded annual growth rate (CAGR)

CAGR is the measure of an investment's annual growth rate over time, with the effect of compounding taken into account. 35.72%* is the CAGR — a constant rate of growth — at which USD 100 would become USD 250 at the end of three years. Wealthy families have complex portfolios spread across multiple asset classes and countries. Return metrics relevant to your investment holding are the following: |

| I Time weighted return (TWR)

TWR measures a fund’s compounded rate of growth over a specific time period. It does not consider the effects of cash inflows and outflows on the growth rate. |

| II Internal rate of return (IRR)

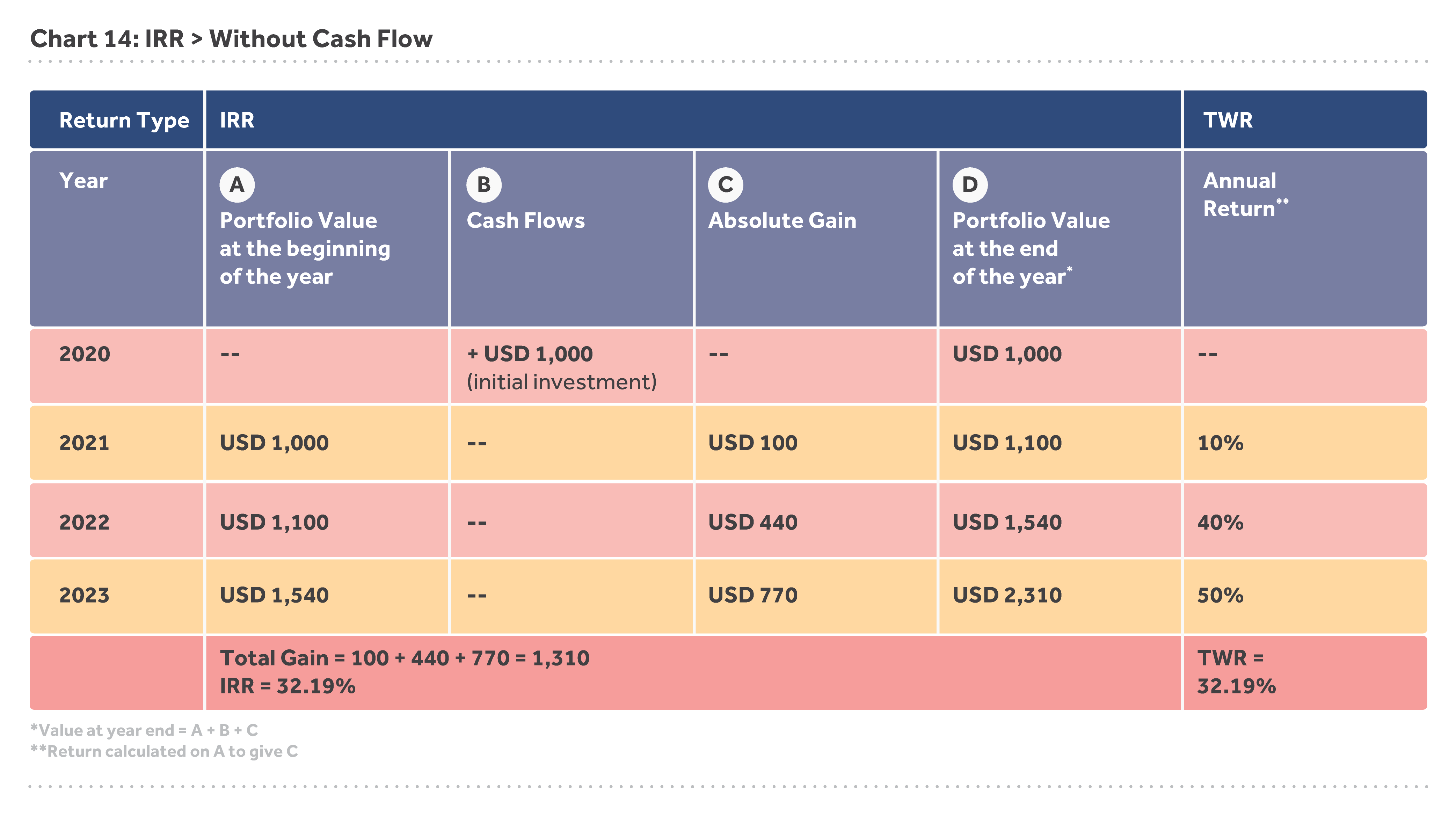

IRR measures the annualized implied discount rate calculated from a series of cash flows. It equates the cost of an investment with the present value of cash generated by that investment. Hence, unlike TWR, it factors in the timing and quantum of cash flows. Where there are no intermediate cash flows in the life of an investment, TWR and IRR are the same. Here is an illustration: A] With Cash Flows *Value at year end = A + B + C **Return calculated on A to give C

B] Without Cash Flows *Value at year end = A + B + C **Return calculated on A to give C

The TWR remains unaffected by the timing of cash flows. This is because it measures returns from the beginning to the end as if there were no cash flows. It considers only the absolute annual return. Hence, in both the illustrations above, the TWR was the same. The purpose and way to use these metrics is given in the portfolio review section below. |

|

|

| Time

Often overlooked, time is the most crucial factor when it comes to optimizing the returns from investment, and forecasting cash flows.

Optimizing returns Time in the market (the amount of time for which an investment is held) is much more important than timing in the market (the time at which you buy or sell an investment).

The longer you hold an investment, the lower the probability of a negative return. The caveat is that the investment should be fundamentally sound. Historically, some of the worst short-term market losses have given way to substantial market recovery. It is essential to not panic and sell holdings during a volatile period.

Forecasting cash flows Before making an investment, determine the time horizon i.e. the number of years before you start using your returns. This prevents the need to sell investments at less than optimum prices, or at a loss, to fulfill liquidity needs.

Divide the time horizon into:

Asset allocation, portfolio rebalancing and portfolio review

This section gives guidance on determining asset allocation strategies. It then cites metrics to periodically review overall portfolio and individual asset class performances through benchmarking. This will further enable families to evaluate financial advisors’ output. Asset allocation

“90% of your portfolio’s risk-adjusted return is connected to your asset allocation” – Findings of a landmark research paper by Brinson, Hood and Beebower, published in 1986

Investments are multi-layered instruments with varying degrees of risks and returns. It is up to families to find the right combination for themselves as per their financial objectives and risk appetite. This includes considering future cash flow requirements.

Determining the asset allocation is more important than the individual investments to be bought. Asset allocation is putting money in a well-thought-out mix that can ride out market volatilities and steadily grow wealth in the long run.

A good mix of assets consists of uncorrelated investments. To have a combination of uncorrelated investments is to possess a well-diversified portfolio. This means not putting all eggs in one basket.

Correlation is the degree to which two securities move in relation to each other. Correlated assets are tied to the same market risks, say, direct equity stock and equity mutual funds. They will rise and fall at the same time and in the same proportion.

Since different investment categories are affected by different types of market conditions, diversifying the portfolio decreases the risk from fluctuations in market returns. Thus diversification protects against losses. If one asset loses value, the others make up for the loss. And, in aggregate, all of them appreciate and beat inflation in the long term.

Diversification helps to balance risk and return.

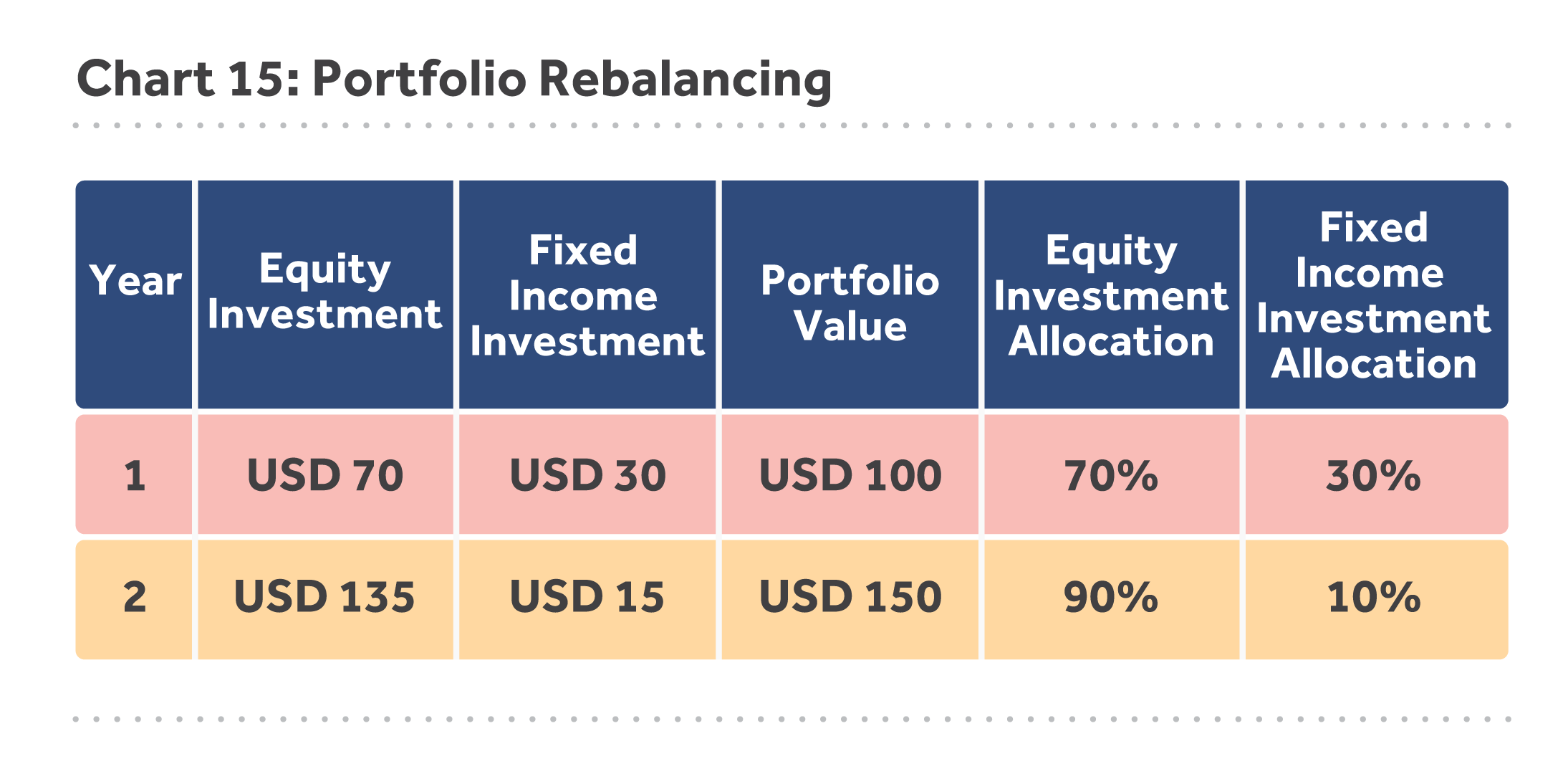

Portfolio rebalancing Rebalancing a portfolio is to bring it back to the original asset allocation proportion. Some investments end up growing faster than others. Over time, this gap in growth rates misaligns the investments from the family’s financial goals.

For example, a boom in the equity market might change your original asset allocation of 70% equity and 30% fixed income to 90% and 10% respectively. This means the risk profile of your portfolio has increased. It is beyond the risk tolerance set during the original asset allocation.

You should now either sell some of your equity investments or buy more of the under-weighted fixed income categories, to restore the asset allocation balance.

By rebalancing your portfolio in this manner, you will be adhering to Warren Buffet’s mantra by default – ‘sell high, buy low’.

Portfolio Review A quarterly review of the holdings is equally important. This applies even to long-term investments. Investments lagging in performance should be replaced with a suitable alternative to earn the best possible returns. The power of compounding means even a 0.1% lesser return can result in a massive lost financial opportunity.

The investment portfolio should be reviewed by benchmarking the returns against those available in the public and private marketplace. This is done using either TWR% or IRR%.

These two metrics should not be compared for the same investment. Their purpose and usage differs from investment to investment.

This is why you need to deploy best practices in creating a responsive and flexible investment grouping while setting up your family investment entities in the performance reporting and general ledger platform.

The investment position grouping, which is distinct from the COA, should enable the family separate their private and public investments. Consolidated groupings where TWR and IRR are presented against the same line items may produce misleading results.

Analyzing the portfolio as a whole gives us a general picture of the overall investments. Asset performance of individual classes, too, needs to be measured using applicable metrics. For example, private equity is a long-term investment. Its full return potential may not be realized until the end of the investment life. Interim performance is measured using the following ratios:

Harness Technology Designing an accounting system integrated with liquid and illiquid investment performance tracking ability can be a daunting task. Even if a family manages to combine these functions by putting manual processes in place and using a tool like Excel, their results are sub-optimal at best. It is also difficult to access information that enables performance measurement by benchmarking with the larger market. Harnessing technology simplifies these activities for families.

The ideal software platform, replete with a document vault, marries a general ledger, applicable accounting standards and investment management and real time market updates. This allows the investors to identify market trends affecting their portfolio and project cash flows so that they can have a better handle on underlying risk and exposure.

Asset Vantage, one of the leading family office software solutions, possesses all of these capabilities. Appendix 9 illustrates a host of its detailed and nuanced investment reporting and accounting prowess. |

|

The road to financial freedom |

| Insurance

Every family is vulnerable to different kinds of risk – personal, financial and business. Insurance against these risks forms a vital part of any sound financial plan for a family office. Payouts from insurance give financial reprieve not only in times of difficulties, but also serve as a liquidity tool in the event of liabilities arising from inheritance/estate taxes and succession planning. |

|

|

| Health, life & crisis management risks

Families usually acquire adequate cover for health and life risks. Some families also take cover for protection against crisis such as security threats, emergency evacuation and repatriation. Care should be taken to ensure that these insurance policies provide international protection. |

In respect of life insurance, the most optimal life cover is provided by term policies. An assured sum is received only if there is a demise during the tenure of the policy. Other types of life insurance offer some benefit even during the lifetime of the policyholder, making it an insurance-cum-investment. But the returns may not always justify the higher premium demanded by such policies. |

|

|

| Financial and business risks

Families may face large liabilities in the forms of inheritance/estate tax or other tax claims. Payouts from life or term insurance received by the beneficiaries can shield a family from such difficult personal and financial situations. They need not forcibly sell family assets to meet sudden liquidity needs. |

Apart from all the standard operating business risk policies, key-man insurance policies are very popular in family owned businesses. Such policies allow the owners to receive a pay-out upon the death of one of their key employees, enabling them to effectively deal with management succession and business losses. |

|

|

| Tracking insurance

Insurance companies are strict and particular. The crucial aid provided by insurance in times of need can be availed only if all of the formalities surrounding the policies are in order. Premium payment must be regular and all documents must be properly maintained. This makes it imperative for a family office to track and monitor its insurance policies pertaining to its various assets, people and nominees all in one place. Your family office system should be able to capture:

|

While forecasting the family office’s cash flows, ensure that cash flows arising out of insurance-related activities are taken into account. Insurance documents should be stored digitally in a systematic manner alongside the entity to which it pertains. Scheduled periodic reviews of all insurance policies must be in place to check for adequate coverage. Comparing the existing policies with alternatives will also help secure optimum protection against risk at reasonable costs. |

|

The road to financial freedom |

| Personal asset management

Personal assets include investments in physical artefacts such as gold, jewelry, art, horses, vintage cars or an aircraft. These can be bought directly or invested in through a fund. You may purchase them for purely portfolio diversification purposes, or out of personal interest and passion. Or they may have been passed down as heirlooms through your family’s generations. Regardless of the intention, they must be taken care of properly if they are to retain their monetary as well as sentimental value. They need to be protected against theft, fire and any unforeseen circumstances. Your family office looks after your private wealth like an organized business. Use the same family office to manage your personal assets as meticulously as your business assets. |

|

|

| Tracking personal assets

Ensure your accounting and reporting system tracks the following information:

|

Documents pertaining to such assets should be carefully stored digitally. These include purchase receipts, valuation reports and insurance documents. Tracking of the assets’ market value and identification of potential risks should take place periodically.

A documented system for regulated access to and maintenance of all your personal assets should be implemented.

Recording all of your personal assets in this fashion creates an inventory of them, which in turn grants better control. |

|

The road to financial freedom |

|

“Your story is the greatest legacy that you will leave to your friends. It’s the longest-lasting legacy you will leave to your heirs.” — Steve Saint

- 1. Family legacy archiving

- 2. Estate planning

- 3. Key takeaways

|

The road to financial freedom |

|

Monetary wealth is earned, sometimes lost, but can be gained again. Its value fluctuates over time. But your legacy is enduring, and only appreciates with every passing day. No matter what the cynics say, you will be remembered less by your money, and more by your story.

To build your legacy – personal as well as business – you need to preserve your family history. And there can be no history without documented evidence of the past. To preserve your documents, you need to establish an archival program. |

|

|

| Why archive?

Archival material outlines your family and business culture and ethos. It documents your growth, changes, and achievements. It is only by looking back and building up on the past that your family can look toward its future, learn from its experiences, and continue to thrive and function well into the next decade or even the century.

Reasons behind missed opportunities, and strategies used to overcome challenges have the power to engage and align the next generation of family members or business leaders with current and future trajectories.

A formally managed archive also has direct commercial value. It is not just a matter for nostalgia but can contribute to the bottom line in the following ways:

|

Archives serve as tools and sources for an empathic understanding of your past and help you maximize what is already uniquely yours: your heritage.

Yet, every day, families lose their valued items to neglect, mishandling and misplacement. Your attentive care can ensure their security. A scientifically maintained archive ensures quick access to your heritage and can be used by you, your family and employees. It will give you all the facts and artefacts to craft your story. |

|

|

| What to archive?

Records can be in many forms like papers, photographs, videos, blueprints, maps, drawings, sound recordings and electronic information. All of them have a life cycle. Information is received or created, used and disposed of as per its relevance. Most records can be destroyed when they are no longer needed. However, a certain percentage of business and personal records have lasting value and should be archived.

To identify valuable items, think of the things that can tell the story of your life. Normally they tend to be operational records of the core functions that shaped and grew the family office, like the minutes of meetings of the decision makers. They can also be private papers of the founders and other members of the family that have significantly contributed to the family office. Personal records relating to non-business activities such supporting charitable foundations or the local sports team, may very well provide insights into the way decision makers run the business. These records place the activities of the business in a broader context. As you go through your items, you may begin to notice patterns in your collecting. Make an effort to locate missing materials to fill out your story.

Generally, the most important offices in your organization will produce the most important records. Many people mistakenly believe that archival records are always ‘old’ records. The value of information does not depend on its age. |

|

|

| How to establish an archival program

If your family and business has stored materials carefully over the years, the existing collection is your starting point. However, in some cases you may be required to start from scratch by sourcing and compiling materials. Your best resources in that case are the oldest living members of your family and organizations.

The following will help you build your collection and piece together your story:

|

|

|

|

| Storage

Proper storage stalls the natural ageing process. Archival material being organic in nature, particularly paper and textiles, are at a risk from damp, mold, insects, pollution, unsuitable packaging and frequent or careless handling. Additionally, organic materials are prone to damage by light. Photographic surfaces are particularly vulnerable.

Keep all vital records in a safe place. Birth certificates, mortgage papers, and other such records should be kept in a fire proof box with copies placed off-site. |

|

|

| Digitization

While conservation and proper storage secures the life of the archival material, digitizing them protects against deterioration from constant wear and tear and eventual loss. Digitization also enables easy sharing and reproduction in various formats.

A successful archival program needs adequate financing for supplies, an effective electronic platform for digital storage, furnishings, and space for storage and research. You can establish your own archival program, or hire a professional archivist/records manager. The story of your family is worth preserving and telling. Appendix 11 gives the classification and list of information you should archive – pertaining both to your family and businesses.

The process of archiving the family history often unearths personal assets of significant value. These need to be accounted for to maintain their worth and procure adequate insurance coverage. Efficient recording of such assets also makes it easy to pass them down to generations. An established family office set-up with the capability to track personal assets and a secure document vault to store documents that tell your legacy will support your archival process. |

|

The road to financial freedom |

|

Estate planning ensures that the wealth and legacy you have built is passed smoothly to the next generation. It would be a shame for either to suffer or lose value on account of conflicts due to ambiguities in succession.

It is natural to put off planning for management of your assets in the event of incapacitation or death. After all, such events seem unlikely and distant. But uncertainty is a way of life, and being prepared has never proved to be unfavorable.

An estate is the aggregate of all your investments and assets – movable as well as immovable. It includes partnership shares in businesses, stocks, debentures, mutual funds, life insurance, bank deposits, intellectual property, and personal assets like paintings and antiques. Liabilities, though not technically part of your asset base, must be properly dealt with in your estate too.

An estate plan takes care of your estate’s management, preservation and legacy, during and after your lifetime, by ensuring the following:

Common estate planning tools include wills, trusts, foundations and insurance. Each of them provide varying degrees of asset protection, tax efficiency and protection from creditors. Trusts are the usually favored route to achieving these objectives.

Effective solutions to estate planning involve the intersection of tax, law, and finance, with both domestic and cross-border considerations. Income, assets, and family members spread across multiple jurisdictions add to the complication.

Determine your family’s core capital and excess capital. The core capital helps to maintain your lifestyle and provide adequate reserves for unexpected commitments. Excess capital, i.e. the assets over and above your core capital, can be safely transferred to the second generation or beyond, without jeopardizing the first generation’s needs. This is known as generation skipping, for which some countries provide tax exemptions.

Major legal considerations pertain to drafting and ensuring the validity of documents. Tax implications also need to be minimized, in both the home country and others. Add to that the constant amendments to law and taxes. The impact of these changes must be understood and managed.

Non-legal or non-tax concerns include business succession, philanthropic activities, privacy and asset tracking, identification and preservation.

Estate planning can be formidable and complex, but lawyers and tax consultants can help you devise a plan customized to your needs. They will help you articulate your wishes clearly, prevent errors, minimize taxes and adjust your plans with changing circumstances.

An integrated accounting and investment system makes all the assets and liabilities that go into the creation of your comprehensive estate plan readily available. It saves you the effort of collating disparate data for making your plan and discussing with your family members and legal advisors. A consolidated view of your personal and financial assets and liabilities, whether they form part of a trust or are earmarked for charity, gives you control over your wealth. You can plan not just from a short term financial perspective, but create lasting security for several generations. Thorough and informed planning, backed by the solid foundation of your family office, maximizes what you leave behind for your loved ones. |

|

The road to financial freedom |

|

“Cybersecurity is much more than a matter of IT.” — Stephane Nappo

- 1. Data security

- 2. Data management

- 3. Key takeaways

|

The road to financial freedom |

| Why you need cyber & data security

Individuals and small organizations tend to be complacent about cybersecurity. Especially since cybercrime is not physical. Like any rare event, it feels impossible it can happen to you—until it does.

The biggest cause of this complacency is assuming the criminals target only very high-value individuals and large organizations. But cyberspace has its own share of petty offenders, who prey on any identified vulnerability.

Opportunity makes the cybercriminal. Whether a piece of information is considered ‘sensitive’ or not, any compromised data can provide leverage to miscreants in their schemes. Every click and movement is tracked and collected. |

Smartphone software particularly adds to the vulnerability. It collects information from every installed app, including mobile banking and investment solutions. The apps themselves, too, gather data, sometimes even when they are not being used.

With the increasing sophistication and expertise of cybercriminals, it is difficult to implement a fool proof security system. Still, family offices can do much to minimize the threat.

This section enumerates best practices in information technology (IT), privacy and access control that every good enterprise-level system should deploy. The practices should be developed with expert advice, and should be well-documented and clearly communicated with all staff members and users. |

|

|

| Password

“Passwords are like underwear: don’t let people see it, change it very often, and you shouldn’t share it with strangers.” – Chris Pirillo, founder and CEO of LockerGnome

Enforcing passwords is the most basic protection measure. It is also the most vulnerable one if password hygiene is treated casually. Staff members and users need to be sensitized to its importance.

Establish a password policy in the organization that mandates the following:

|

|

|

|

| Encryption

Encryption is converting information or data into a code, so that it is unreadable to users who do not possess the decryption key. Strong encryption is the best technical defense against most cyberattacks.

End-to-end encryption protects data while it is in transit. If established in its most secure form, the individuals at each end of the message themselves hold the keys for decoding and recoding the message, and not any third party.

Encryption should be installed throughout the network for all devices, data and communication channels:

|

Without encryption, criminals can easily intercept plain-text that is stored and transmitted on networked computers.

Establish a firm organization policy of not emailing unencrypted or non-password protected documents, spreadsheets and PDFs, especially not if they contain sensitive and personal information. |

|

|

| Inter-process authentication

With internet computing, different software functions or components, such as web, application or database servers, are often not on the same physical computer. But they still need to interoperate to produce the desired outcome.

Inter-process authentication uses a specific type of encryption — using keys that are certified by an authority — to ensure each computer and program can mathematically “prove” their identity. Which means only authenticated programs on the network can exchange information with each other.

This measure protects the data transmitted between different computer programs.

|

|

|

| Application software

It is essential to regularly update the software applications in use. These updates rectify vulnerabilities which criminals could exploit.

Regular audits should flag software that is not up-to-date on any system on the network. |

|

The road to financial freedom |

| User access and management

“We discovered in our research that insider threats are not viewed as seriously as external threats, like a cyberattack. But when companies had an insider threat, in general, they were much more costly than external incidents. This was largely because the insider that is smart has the skills to hide the crime, for months, for years, sometimes forever.”— Dr Larry Ponemon, chairman and founder of Ponemon Institute

Preventive measures to protect the family office from potential human threats within the organization are:

|

|

|

|

| Document management

Digital as well as physical documents need to be handled and stored securely.

|

|

|

|

| Backup

Regular backups are a hedge against data loss. They prevent disruption to operations.

|

|

|

| Network security

Your network must be accessible only to authorized personnel.

Restrict access to Software-as-a-Service application to local network firewalls and Virtual Private Networks (VPNs). Even if you use a third-party server, it should be accessed only through your private network. |

|

|

| Audit capability

Do not use systems that do not have audit trail generation and reporting capabilities. Your wealth’s security is tied to having a firm control over IT and data security. |

|

The road to financial freedom |

|

“We don't have to be smarter than the rest; we have to be more disciplined than the rest." — Warren Buffett

- SOP : Income and Expense Journalizing and Reconciliation

- SOP : Fixed Assets procurement, disposal, physical verification and depreciation

- SOP : Bank and Custodian Reconciliation

- SOP : Financial Closing and Reporting

- SOP : Investment Execution for Equity Trade

- SOP : Investment Management

- Sample Compliance Calendar

- Sample Investment Policy Statement

- AV Insights

- Online Educational Resources for Family Wealth Planning and Management

- Business Records to Archive

- Disclaimer

- Acknowledgement

- Summary

|

The road to financial freedom |

Appendix 1: Income and Expense Journalizing and Reconciliation Standard Operating Procedure (SOP)This section lists best practices to be followed for accounting income received or receivable from these key sources:

Dividend income – equity

Dividend received – mutual fund

Savings bank interest

Interest on bonds

Optional fully convertible debentures (OFCD)/loans

Rent received

Fee income

This section lists best practices to be followed for key direct and indirect expenses incurred to support the investment management activity:

Salary and wages

Travel expenses Design a policy for travel expense eligibility. It should encompass allowable expense by each account head (hotel, travel, food, etc.) for all employee levels. The steps to process travel advances, claims and accounting are:

Travel advance Perform the following checks on receipt of request for travel advance:

Travel expense claim/reimbursement Perform the following checks on receipt of travel expense claim:

Rent/Lease expenses These expenses may be incurred on rented premises or on equipment on lease. The following process should be followed for processing and accounting of invoice for rent/lease:

Outsourced services These cover accounting, legal and advisory, payroll processing, housekeeping security, etc. The steps for processing and accounting for such expenses are:

Other expenses Other expenses include utilities, insurance, printing, etc. The process for processing and accounting for such expenses is:

Payment processing Expenses can be paid using one or more of the following modes:

Cheque and net banking:

Petty cash should deal with small and non-recurring expenses only. Recurring expenses and expenses of significant accounts should be processed only through bank.

These are the steps to be followed for processing and accounting of petty cash expenses:

|

|

The road to financial freedom |

Appendix 2: Fixed Assets procurement, disposal, physical verification and depreciation SOPThe steps for procurement of assets are:

Disposal The steps for disposal of assets are:

Physical Verification of Assets

Depreciation

|

|

The road to financial freedom |

Appendix 3: Bank and Custodian Reconciliation SOP

Bank Reconciliation

Custodian Reconciliation Custodian reconciliation enables users to match investment position quantity, cost price, market price, market valuation and cash position as on a particular date.

The accounts team should reconcile investments recorded in the books of accounts with each custodian statement. The steps are:

|

|

The road to financial freedom |

Appendix 4: Financial Closing and Reporting SOPThis appendix contains the necessary activities to be carried out for period closing.

Provision of Expenses

Prepaid Expenses Prepaid expenses are upcoming expenses paid in advance, partly or fully. Follow these steps to account for them:

Provision for Doubtful Debts, and Writing-Off Bad Debts

Provision for Gratuity

Balance Confirmation of Debtors and Creditors

Inter-Entity & Intercompany Reconciliation

|

|

The road to financial freedom |

Appendix 5: Investment Execution Process for Equity Trade

Pre-Trade Activity Process

Execution and Post-Trade Activity Process

|

|

The road to financial freedom |

Appendix 6: Investment Management SOP

Investments Made

Accounts team to follow the following steps for processing and accounting of investments made:

Investment Redemption

Accounts team to follow the following steps for redemption of investments:

|

|

The road to financial freedom |

Appendix 8: Sample Investment Policy Statement

Note: All of these operating procedures are reflective of what many global family offices do in the real world. Nevertheless, they are generic, illustrative and recommendatory in nature. They may differ across family office jurisdictions and must be adopted only after consultation with the family office’s local accounting and legal professionals.

Procedures for complicated transactions, like an inter-entity transfer, and country-specific compliance calendars and practices for accounting can be found in the appendix. |

|

The road to financial freedom |

Appendix 9: AV InsightsAsset Vantage’s AV Insights offers the following capabilities:

|

|

The road to financial freedom |

Appendix 10: Online Educational Resources for Family Wealth Planning and Management |

|

The road to financial freedom |

Appendix 11: Business Records to Archive

Corporate Records

Public Relations and Corporate Communications

Staff Employment Records

Production / Operational Records

Legal Records

Premises and Property Records

Accounting and Financial Records

Sales and Marketing Records

Other Records

Family Papers / Private Papers

Oral History Collection Reminiscences of:

|

|

The road to financial freedom |

|

All of the operating procedures set forth in this handbook have been designed based on our experience from working with hundreds of global family offices. The suggested best practices and processes are generic and illustrative. They must be implemented as per individual family office requirements, in consultation with the family office’s local accounting and legal professionals.

All recommendations, advices or opinions cited are the professional views of Asset Vantage. Readers must act upon them with due diligence.

Asset Vantage is not a wealth advisor or wealth manager, and does not accept any responsibility or liability for the actions or inactions, on the part of any individual or firm, stemming from the information in this document. |

|

The road to financial freedom |

|

To develop the handbook, we, at Asset Vantage, have drawn wisdom from our own history: a family office which reinvented itself after the financial crisis of 2008. The best practices we have put together in these pages have been gleaned empirically, after partnering with hundreds of global clients. Our commitment to empowering families to take charge of their own wealth is fuelled by the processes developed by our team, who are global experts in the fields of investments, accounting and software technology.

The external sources from which insights and content have been drawn are:

Editorial and design services were provided by Payal Morankar, Ritika Arya and Needhi Bharmani of teammagenta. |

|

The road to financial freedom |

| Handbook Summary

Family Offices may once have been the preserve of the ultra-rich - but no more! Developed by Asset Vantage, this handbook demystifies how to set up and run a world-class family office. The leading global investment accounting solutions firm has revealed the hard to find industry best practices. Accessible and savvy, The Handbook sets you on a path to multiplying wealth and achieving financial freedom. |

GET THE FAMILY OFFICE HANDBOOK

Enter your email ID to get your personal copy of the Family Office Handbook and other 4.0 updates