Empowering an Australian Family Office to make better investment decisions

Managing a family office’s global portfolio holdings can be a daunting task, especially when one has to deal with outdated tools that are not designed to provide a complete picture of the investments. With the rise of technology, manual support is no longer secure or accurate, and unforeseen issues like staffing shortages can affect a business’s operations.

An Australian family office feels the heat

A single-family office from NSW, Australia with global portfolio holdings was on the lookout to simplify their work through automation. Here’s why

- Tools like Excel, Quickbooks, Sage, and Xero are like a square peg trying to fit a round hole. They are not designed to provide families with the complete investment picture.

- Complete dependency on manually tracking a complex investment portfolio is neither secure nor accurate, and a staffing shortage was affecting their business.

The family was, therefore, looking for a better alternative – an automated GL system offering consolidation of multiple asset classes including alternative investments.

Unfortunately, the options available were few and far between and were built only for institutions and advisors.

And then there was one

Out of all the available technology platform options in the market, only one was found to be uniquely equipped to address the core needs of this single-family office and offered:

- The right software: A GL-based system that provided performance reporting.

- A responsive support team: With quick engaging responses and time zone overlap.

- Customized features: This flexible platform met crucial requirements like allowing the dissection of holdings by currency, asset class, geography, etc. The feature suite that included multi-currency reporting seemed tailor-made for the client and sweetened the deal.

- Transparent & pocket-friendly pricing: Overall costs, right from exciting trial and implementation prices to the product subscription, were a no-brainer compared to other competing platforms.

The light at the end of the tunnel

By leveraging the features and integrated customer support team of this technology partner, this renowned Australian single-family office was able to address its most crucial requirements and successfully transition to an automated GL system.

The family office now has:

- An actionable view of their consolidated portfolio that can be sliced using multiple parameters.

- Anytime access to live reporting and updates.

- All of this without maintaining a separate General Ledger system.

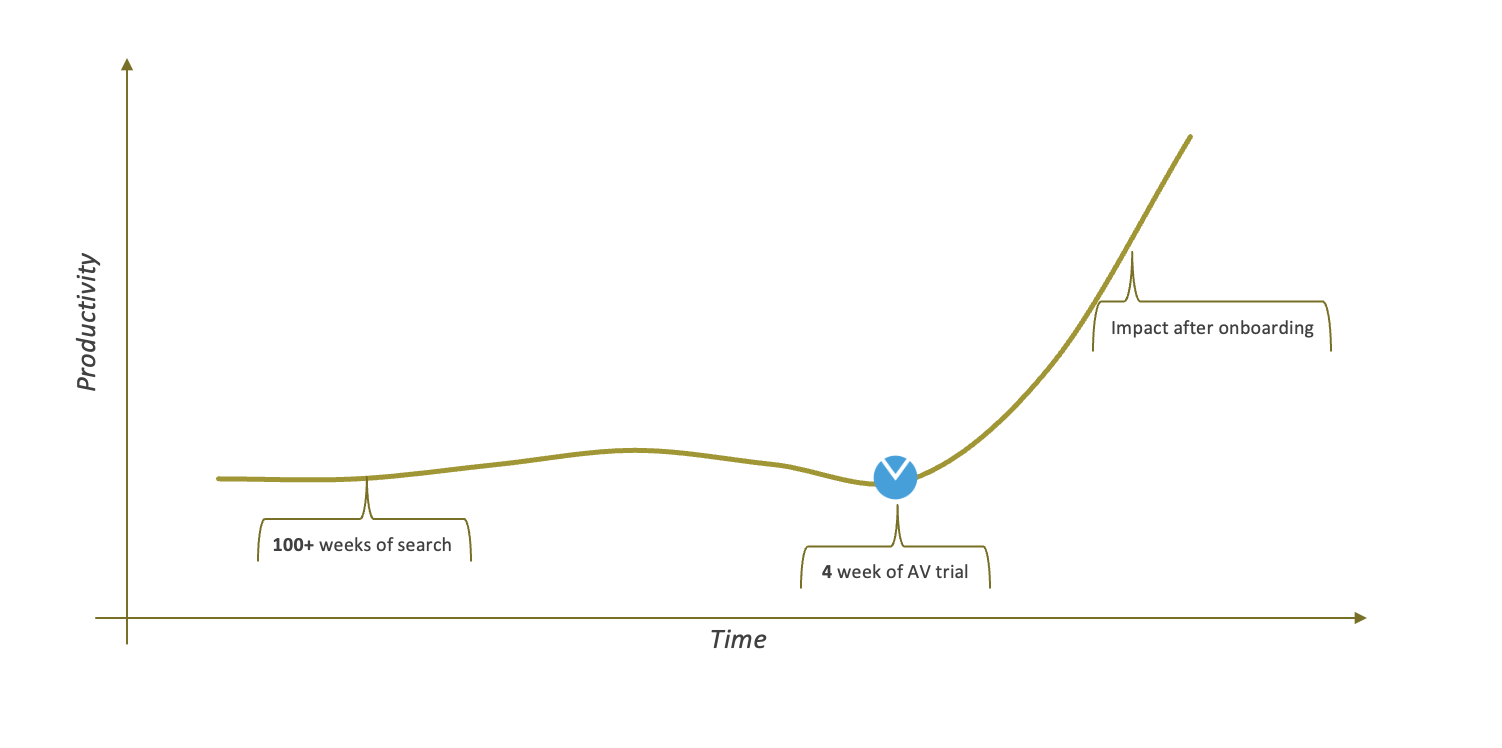

With Asset Vantage it took the Australian Family office just 12 weeks from ‘searching’ to ’go-live’

What was the right answer for this family office at the end of the day?

What was the right answer for this family office at the end of the day?

Asset Vantage – An integrated performance reporting and general ledger technology that empowers families to make better investment decisions. AV is a modern, cost-efficient, and effective offering with all the features that the right platform must have and does all the heavy lifting so that our customers can focus on running their family office.

See how Asset Vantage can empower your family office operations.

Speak to us and let us show you how AV can help you make better-informed decisions