Missed deadlines or errors in legal, regulatory, and tax reporting produce unnecessary risk and potential losses for the firm and the family. These can be avoided when systems are established to provide regular reminders.

Compliance Matters

Compliance calendars record the frequency of payments and their due dates under different applicable statutes. They serve as the basis of all compliance activities. Sample compliance calendars are in Appendix 7.

Legal Matters

A tracking system for legal matters should be created in which the responsible team can notify and update details, such as:

- Name

- Issue

- Date

- Mode of notification

- Status (ongoing/closed)

- Actions taken with dates and remarks.

An independent checker should verify the tracker periodically to ensure that timely actions are taken. All documents should be scanned and maintained for future references.

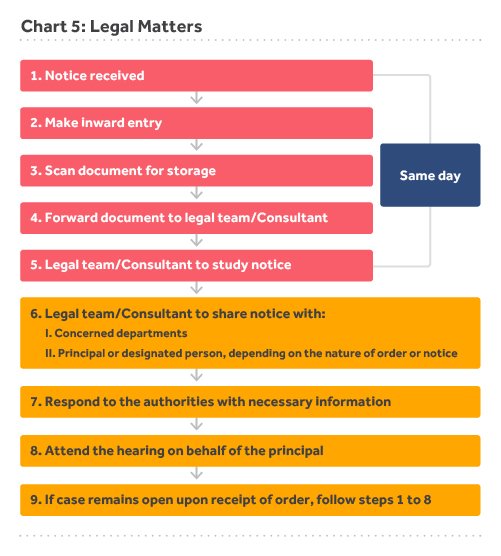

The following diagram outlines the process to be followed on receipt of an order or notice:

Audit is an indispensable part of any enterprise. If you are to run your family office as meticulously as a business, the family office, too, needs to have thorough internal and external audit processes in place.

An audit is an important checking and verification tool. It enables control over and visibility of operations. It protects from frauds, identifies loopholes and highlights areas that can be improved.

Audits must be performed on:

- Entities

- Accounts

- Investments including illiquid investments like real estate and personal assets

- Documents

- Internal processes and user management